Diving into the world of venture capital funds, we uncover the secrets behind funding startups and driving innovation to new heights. Get ready for a rollercoaster ride through the highs and lows of investing in the future!

As we delve deeper, we’ll explore the different types of venture capital funds and how they shape the entrepreneurial landscape.

Types of Venture Capital Funds

Venture capital funds can be categorized into different types based on their investment focus and structure. Each type has its own characteristics and target companies. Let’s explore the various types of venture capital funds below:

Early-Stage Venture Capital Funds

Early-stage venture capital funds focus on investing in startups that are in the initial stages of development. These funds typically provide seed funding to help startups launch their products or services. They are high risk but offer the potential for high returns if the startup succeeds.

Expansion-Stage Venture Capital Funds

Expansion-stage venture capital funds invest in companies that have already established a product-market fit and are looking to scale their operations. These funds help companies grow and expand their market reach. They are less risky compared to early-stage funds but still offer significant growth opportunities.

Late-Stage Venture Capital Funds

Late-stage venture capital funds focus on investing in mature companies that are close to an initial public offering (IPO) or acquisition. These funds provide the capital needed for companies to reach the next level of growth and profitability. They are lower risk investments compared to early-stage funds but offer lower returns.

Corporate Venture Capital Funds

Corporate venture capital funds are established by corporations to invest in startups that align with their strategic goals. These funds not only provide capital but also strategic resources and industry expertise to help startups succeed. They offer a unique opportunity for startups to access the resources of a larger corporation.

Social Venture Capital Funds

Social venture capital funds focus on investing in companies that have a social or environmental mission. These funds prioritize companies that are making a positive impact on society while still generating financial returns. They offer a way for investors to support socially responsible businesses.

Compare and Contrast

– Early-stage funds are high risk/high reward, while late-stage funds are lower risk/lower reward.

– Expansion-stage funds focus on scaling companies, while corporate venture capital funds provide strategic resources.

– Social venture capital funds prioritize social impact, while traditional funds focus on financial returns.

How Venture Capital Funds Work

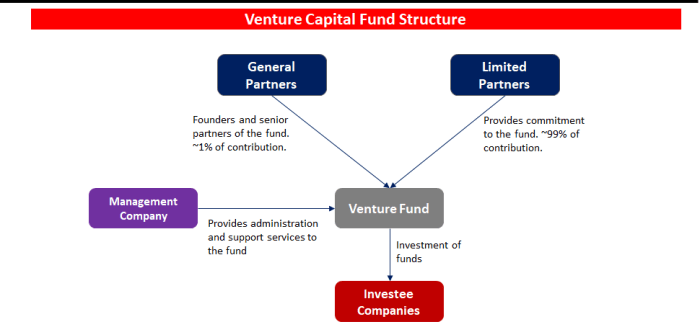

Venture capital funds operate by raising money from investors and then using that capital to invest in early-stage companies with high growth potential. These funds are managed by professional venture capitalists who have expertise in evaluating startups and helping them grow.

Process of Venture Capital Funds

- Venture capital funds raise money from institutional investors, wealthy individuals, and other sources.

- They then identify promising startups to invest in, conducting thorough due diligence to assess the company’s potential for success.

- Once an investment is made, venture capitalists provide guidance, mentorship, and networking opportunities to help the startup scale and succeed.

- As the company grows and achieves milestones, the venture capital fund may exit the investment through an acquisition or an initial public offering (IPO), generating returns for their investors.

Examples of Successful Investments

- Google: In 1998, Sequoia Capital invested $12.5 million in Google, which turned out to be one of the most successful venture capital investments of all time.

- Facebook: Accel Partners invested $12.7 million in Facebook in 2005, a stake that would be worth billions of dollars today.

- Uber: Benchmark Capital invested $11 million in Uber in 2011, which grew into a multi-billion dollar company.

Role in Supporting Startups and Innovation

Venture capital funds play a crucial role in supporting startups by providing not just financial capital, but also strategic guidance, valuable industry connections, and operational expertise. By taking calculated risks on early-stage companies, venture capital funds fuel innovation and drive economic growth by helping startups bring disruptive ideas to market.

Benefits and Risks of Venture Capital Funding

When it comes to venture capital funding, there are both advantages and risks that entrepreneurs need to consider before seeking investment.

Advantages of Securing Funding from Venture Capital Firms

- Venture capital firms provide not only financial support but also valuable expertise and connections to help grow your business.

- Investors are typically willing to take higher risks in exchange for potentially high returns, allowing startups to access larger amounts of capital than traditional loans.

- Having a venture capital firm on board can increase the credibility of your business, making it easier to attract future investors.

Potential Risks Associated with Venture Capital Investments

- Venture capital funding often involves giving up a portion of ownership and control of your business, which can lead to conflicts over strategic decisions.

- There is a high level of pressure to achieve rapid growth and profitability, which may not align with the long-term goals of the founders.

- If the business fails to meet the expected milestones, it can result in the venture capital firm taking control or shutting down the company.

Examples of Successful and Unsuccessful Outcomes of Venture Capital Funding

- Successful Outcome: Companies like Google, Facebook, and Amazon were able to achieve massive growth with the help of venture capital funding, leading to significant returns for both the entrepreneurs and investors.

- Unsuccessful Outcome: On the other hand, companies like Theranos and Juicero failed spectacularly despite receiving substantial funding from venture capital firms, highlighting the risks involved in such investments.

Impact of Venture Capital Funds on the Economy

Venture capital funds play a crucial role in driving economic growth by providing funding to innovative startups and high-growth potential companies. This financial support helps these businesses to develop new products, expand their operations, and create value in the market.

Contribution to Economic Growth

- Venture capital funds inject capital into early-stage companies, allowing them to scale up and bring new ideas to the market.

- By funding innovative ventures, these funds stimulate competition and drive technological advancements, leading to overall economic progress.

- The success of funded companies can attract more investors, creating a cycle of growth and investment in the economy.

Influence on Job Creation

- Venture capital investments often result in job creation as funded companies expand their operations and hire more employees.

- New job opportunities in innovative industries contribute to reducing unemployment rates and boosting economic activity.

- Furthermore, the skills and expertise developed within these companies can lead to a more skilled workforce, benefiting the economy in the long run.

Long-Term Effects on Industries and Markets

- Venture capital funding can disrupt traditional industries by supporting disruptive technologies and business models.

- Successful startups funded by venture capital can become industry leaders, shaping market trends and driving innovation across various sectors.

- Over time, the ripple effects of venture capital investments can lead to the transformation of entire industries, creating new opportunities and driving economic growth.