Dive into the world of personal loan interest rates, where numbers and percentages hold the key to your financial future. Brace yourself for a rollercoaster ride of fixed rates, variable rates, and everything in between.

Get ready to uncover the secrets behind what makes those interest rates tick and how they can impact your wallet.

Overview of Personal Loan Interest Rates

When it comes to personal loan interest rates, it’s all about the money you’ll pay on top of the amount you borrowed. These rates can vary based on a variety of factors, so let’s break it down.

Calculation of Personal Loan Interest Rates

Personal loan interest rates are typically calculated based on the principal amount borrowed and the annual percentage rate (APR). The APR includes not only the interest rate but also any additional fees associated with the loan. The total amount to be repaid is the principal amount plus the interest accrued over the loan term.

Factors Affecting Personal Loan Interest Rates

- Your Credit Score: A higher credit score usually means lower interest rates as you are considered less risky to lenders.

- Loan Term: Shorter loan terms often come with lower interest rates compared to longer terms.

- Income and Debt-to-Income Ratio: Lenders may adjust interest rates based on your income and existing debt obligations.

- Market Conditions: Economic factors can influence interest rates across the board, affecting personal loans as well.

Types of Personal Loan Interest Rates

When it comes to personal loans, borrowers often have the choice between fixed and variable interest rates. Each type has its own set of advantages and disadvantages, so it’s important to understand the differences before making a decision.

Fixed Interest Rates

Fixed interest rates remain constant throughout the life of the loan, providing borrowers with predictable monthly payments. This type of interest rate is ideal for individuals who prefer stability and want to budget with certainty. However, if market interest rates decrease, borrowers with fixed rates will miss out on potential savings.

Variable Interest Rates

Variable interest rates fluctuate based on market conditions, meaning monthly payments can vary over time. While borrowers may benefit from lower rates when market conditions are favorable, they also face the risk of higher payments if rates increase. This type of interest rate is suitable for individuals who are willing to take on some level of risk in exchange for potential cost savings.

In conclusion, choosing between fixed and variable interest rates depends on individual preferences and financial goals. Those who prioritize stability and predictability may opt for a fixed rate, while those comfortable with fluctuations and potential savings may prefer a variable rate.

Factors Influencing Personal Loan Interest Rates

When it comes to personal loan interest rates, there are several key factors that lenders take into consideration before determining the rate they offer to borrowers.

Credit Score and Credit History

Your credit score and credit history play a significant role in influencing the interest rate you are offered on a personal loan. Lenders use this information to assess your creditworthiness and determine the level of risk associated with lending to you. Generally, individuals with higher credit scores are more likely to qualify for lower interest rates, as they are considered less risky borrowers. On the other hand, borrowers with lower credit scores may be offered higher interest rates to offset the increased risk to the lender.

Market Conditions

Market conditions also play a crucial role in determining personal loan interest rates. Factors such as the current state of the economy, inflation rates, and the overall interest rate environment can impact the rates offered by lenders. During periods of economic uncertainty or high inflation, lenders may increase interest rates to account for the greater risk of default. Conversely, in a low-interest-rate environment, borrowers may be able to secure more favorable rates on their personal loans.

Comparison of Personal Loan Interest Rates

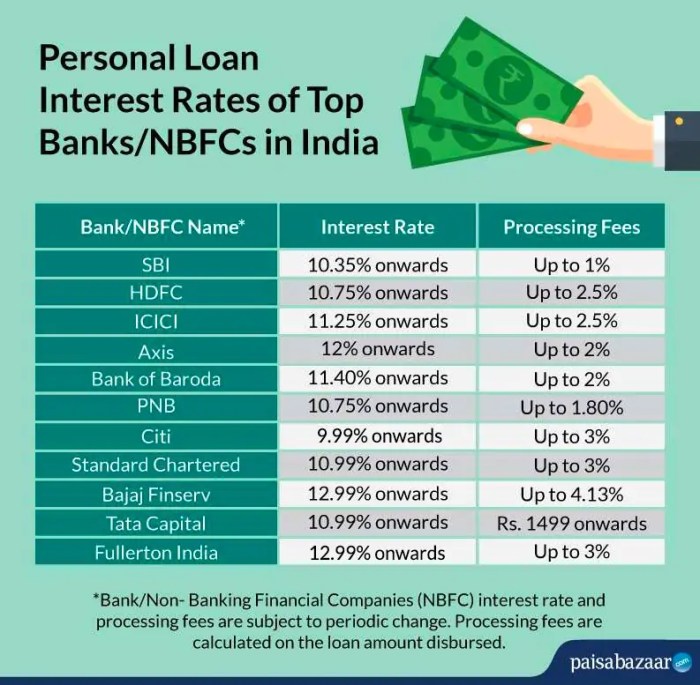

When looking for a personal loan, it’s crucial to compare the interest rates offered by different types of lenders. Banks, credit unions, and online lenders all have their own rates, and finding the best one can save you money in the long run.

Types of Lenders and Their Rates

- Banks: Traditional banks may offer competitive rates, especially if you have a good relationship with them or a high credit score.

- Credit Unions: Credit unions often have lower interest rates compared to banks, as they are member-owned and not-for-profit organizations.

- Online Lenders: Online lenders may have higher interest rates, but they often provide quick approval processes and convenient services.

Impact of Loan Term Length

- Shorter Loan Terms: Shorter loan terms usually come with lower interest rates, but higher monthly payments.

- Longer Loan Terms: Longer loan terms may have higher interest rates, but lower monthly payments, spreading the cost over a longer period.

Tips for Finding the Best Rates

- Compare Offers: Shop around and compare rates from different lenders before committing to a personal loan.

- Check Your Credit Score: A higher credit score can help you qualify for lower interest rates.

- Negotiate: Don’t be afraid to negotiate with lenders to see if you can secure a better rate based on your financial situation.