Get ready to dive into the world of mortgage payment calculators, where numbers meet strategy and planning. This guide will take you through the ins and outs of using this powerful tool to make informed financial decisions.

Introduction to Mortgage Payment Calculator

When it comes to buying a home, understanding your mortgage payments is essential. This is where a mortgage payment calculator comes in handy. It is a tool that helps you estimate your monthly mortgage payments based on factors like loan amount, interest rate, and term.

Benefits of Using a Mortgage Payment Calculator

- Allows you to plan your budget: By using a mortgage payment calculator, you can get a clear idea of how much you need to set aside each month for your mortgage.

- Helps in comparing loan options: You can input different loan amounts, interest rates, and terms to see how they affect your monthly payments, making it easier to choose the best option.

- Assists in understanding the impact of interest rates: The calculator shows you how changes in interest rates can affect your payments, helping you make informed decisions.

Overview of How a Mortgage Payment Calculator Works

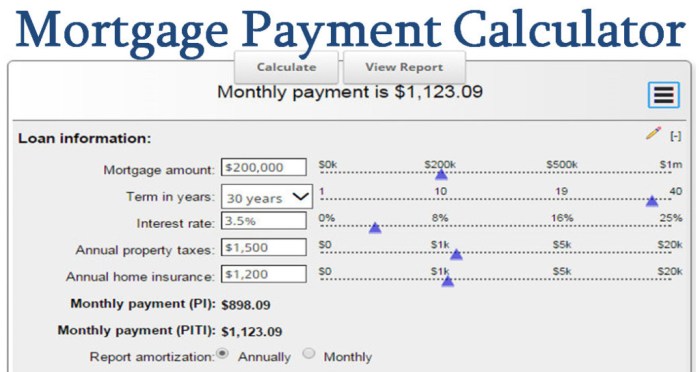

A mortgage payment calculator uses a formula to calculate your monthly payments based on the loan amount, interest rate, and term. It takes into account factors like property taxes, insurance, and private mortgage insurance (PMI) if applicable.

Using a Mortgage Payment Calculator

When it comes to managing your finances and planning for the future, using a mortgage payment calculator can be a valuable tool. This tool helps you estimate your monthly mortgage payments based on different variables like loan amount, interest rate, and term. By understanding how to use a mortgage payment calculator effectively, you can make informed decisions about your home buying process.

Step-by-step Guide

To use a mortgage payment calculator, follow these simple steps:

- Enter the loan amount: Input the total amount of money you plan to borrow for your mortgage.

- Input the interest rate: Specify the interest rate that will be applied to your loan.

- Choose the loan term: Select the number of years you will be repaying the loan.

- Click on the calculate button: After entering all the necessary information, click the calculate button to see the results.

Results Provided

Once you have inputted the required variables, the mortgage payment calculator will provide you with essential information such as:

- Monthly payment: The amount you need to pay each month towards your mortgage.

- Total interest: The total amount of interest you will pay over the life of the loan.

- Total payment: The sum of all your payments, including both principal and interest.

Understanding Mortgage Terms in Calculator Results

When using a mortgage payment calculator, it’s essential to understand key terms that impact your monthly payments. These terms include principal, interest, and escrow, each playing a crucial role in determining the total amount you pay each month.

Principal:

– The principal is the initial amount borrowed for the mortgage. It is the total amount of money you owe to the lender.

– In the calculator results, the principal is reflected as the starting balance of your loan. As you make payments, the principal balance decreases.

Interest:

– Interest is the cost of borrowing money from the lender. It is calculated based on the interest rate and the remaining principal balance.

– In the calculator results, the interest portion of your monthly payment is displayed. The higher the interest rate, the more you will pay in interest over the life of the loan.

Escrow:

– Escrow is the account where funds are held to pay property taxes and homeowners insurance. These expenses are typically paid along with your mortgage payment.

– In the calculator results, the escrow portion shows the estimated amount set aside each month for taxes and insurance. This helps ensure these expenses are covered when they are due.

Impact of Changes in Mortgage Terms

Changes in these terms can have a significant impact on your overall mortgage payment:

– Increasing the principal amount will result in higher monthly payments, as you are borrowing more money.

– A higher interest rate will lead to increased interest payments, raising the total cost of the loan.

– Adjusting the escrow amount can affect your monthly payment if property taxes or insurance costs change.

Understanding these terms and how they affect your mortgage payment can help you make informed decisions when using a mortgage payment calculator. By inputting accurate information, you can better estimate your monthly expenses and plan for the future.

Benefits of Using a Mortgage Payment Calculator

Using a mortgage payment calculator can provide numerous benefits, making the process of budgeting, financial planning, and loan comparison much easier and more efficient.

Compare Manual Calculations vs. Using a Mortgage Payment Calculator

When manually calculating mortgage payments, there is a higher risk of errors due to complex formulas and math involved. On the other hand, a mortgage payment calculator provides accurate results instantly, saving time and ensuring precision in calculations.

How a Calculator Helps in Budgeting and Financial Planning

A mortgage payment calculator allows individuals to input various loan terms and interest rates to determine monthly payments. This helps in creating a realistic budget and financial plan by understanding the affordability of different loan options before committing to a specific mortgage.

Calculator Aids in Comparing Different Loan Options

By using a mortgage payment calculator, individuals can easily compare various loan options side by side. This allows borrowers to see the impact of different interest rates, loan terms, and down payment amounts on monthly payments, enabling them to make informed decisions based on their financial situation and goals.