Yo, diving into the world of income tax on investments is like unlocking a secret code to make your money work smarter, not harder. Get ready to navigate the maze of taxes and investments with finesse.

So, buckle up as we break down the complexities of income tax on investments and show you how to level up your financial game.

Overview of Income Tax on Investments

Investors need to be aware of the income tax implications on their investment activities. Income tax on investments refers to the taxes levied on the income generated from various investment vehicles such as stocks, bonds, mutual funds, real estate, and other financial instruments.

Types of Investments Subject to Income Tax

- Stocks: Capital gains from the sale of stocks are subject to capital gains tax.

- Bonds: Interest income earned from bonds is taxed as ordinary income.

- Mutual Funds: Dividends and capital gains distributions from mutual funds are taxable.

- Real Estate: Rental income from real estate properties is subject to income tax.

Importance of Understanding Tax Implications on Investments

It is crucial for investors to understand the tax implications on their investments for several reasons:

- Maximizing Returns: By considering tax implications, investors can structure their investments in a tax-efficient manner to maximize their after-tax returns.

- Compliance: Understanding tax laws helps investors comply with reporting requirements and avoid penalties.

- Strategic Planning: Knowledge of tax implications allows investors to make informed decisions and plan their investment strategies accordingly.

Taxable vs. Non-Taxable Investments

When it comes to investing, it’s important to understand the difference between taxable and non-taxable investments. Taxable investments are subject to taxes on the income they generate, while non-taxable investments are not taxed at the same rate or may even be tax-exempt.

Taxable investments include:

- Stocks

- Bonds

- Mutual funds

- Real estate investments

Non-taxable investments include:

- Municipal bonds

- Roth IRA

- Health Savings Account (HSA)

- 529 college savings plan

Tax Treatment of Taxable vs. Non-Taxable Investments

Taxable investments are typically subject to capital gains tax when you sell them for a profit. The tax rate depends on how long you held the investment. On the other hand, non-taxable investments like municipal bonds may be exempt from federal taxes and sometimes state taxes.

It’s essential to factor in the tax implications of your investments when making financial decisions.

Capital Gains Tax

When it comes to investments, capital gains tax is the tax imposed on the profit made from selling an asset like stocks, bonds, or real estate.

Calculating Capital Gains Tax

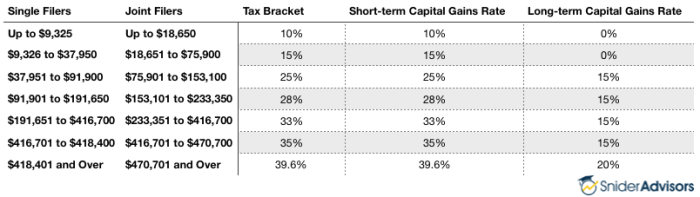

To calculate capital gains tax, you first need to determine the asset’s basis, which is typically the original purchase price plus any additional costs like commissions or fees. Then, subtract the basis from the selling price to get the capital gain. This gain is then taxed at either short-term or long-term capital gains rates, depending on how long you held the asset.

- Short-term capital gains tax applies to assets held for one year or less and is taxed at ordinary income tax rates.

- Long-term capital gains tax applies to assets held for more than one year and is taxed at lower rates than ordinary income tax rates.

Minimizing Capital Gains Tax

There are a few strategies you can use to minimize capital gains tax on investments:

- Hold onto investments for more than one year to qualify for lower long-term capital gains tax rates.

- Offset capital gains with capital losses by selling losing investments to reduce your tax liability.

- Utilize tax-advantaged accounts like IRAs or 401(k)s, where investments can grow tax-free or tax-deferred.

- Consider gifting appreciated assets to charity to avoid paying capital gains tax altogether.

Dividend Income Tax

When it comes to dividend income tax, it’s essential to understand how this type of income is taxed, the tax rates that apply, and any deductions or exemptions available to taxpayers.

Taxation of Dividend Income

Dividend income is typically taxed at different rates depending on whether the dividends are considered qualified or non-qualified. Qualified dividends are those that meet specific criteria set by the IRS, while non-qualified dividends do not meet these criteria.

Tax Rates for Dividend Income

For the tax year 2021, qualified dividends are taxed at the capital gains tax rates, which range from 0% to 20% depending on the taxpayer’s income level. On the other hand, non-qualified dividends are taxed at ordinary income tax rates, which can go as high as 37%.

Deductions and Exemptions

There are certain deductions and exemptions available for dividend income tax, such as the qualified business income deduction for eligible taxpayers and the foreign tax credit for taxes paid on dividends received from foreign companies. These deductions and exemptions can help reduce the overall tax liability on dividend income.

Interest Income Tax

Interest income from investments is taxed at different rates depending on the type of interest earned. The tax treatment of interest income can vary based on whether it is considered ordinary income or qualified dividends.

Tax Treatment of Different Types of Interest Income

Interest income can be classified as either ordinary income or qualified dividends for tax purposes. Ordinary income is taxed at your regular income tax rate, which can range from 10% to 37%. On the other hand, qualified dividends are taxed at a lower rate of either 0%, 15%, or 20%, depending on your taxable income and filing status.

Examples of investments that generate interest income include:

- Savings accounts

- Certificates of deposit (CDs)

- Treasury bonds

- Corporate bonds

The tax implications of interest income from these investments will depend on whether the interest is classified as ordinary income or qualified dividends. It’s essential to understand the tax treatment of different types of interest income to accurately report them on your tax return.

Foreign Investment Tax

When it comes to foreign investment tax, it’s important to understand how income tax on foreign investments is calculated. This involves considering any special considerations or treaties that may affect the taxation of foreign investments. Additionally, knowing the reporting requirements for foreign investment income is crucial to staying compliant with tax laws.

Calculation of Tax on Foreign Investments

When calculating income tax on foreign investments, the IRS considers various factors such as the type of income (e.g., interest, dividends, capital gains), the country of origin, and any applicable tax treaties. It’s essential to report all foreign investment income accurately on your tax return to avoid penalties or audits.

Special Considerations and Tax Treaties

Certain countries may have tax treaties with the United States that impact how foreign investment income is taxed. These treaties often address issues such as double taxation, tax rates, and exemptions. Understanding these treaties can help investors minimize their tax liability and comply with international tax laws.

Reporting Requirements

Reporting foreign investment income typically involves filing additional forms with your tax return, such as Form 8938 (Statement of Specified Foreign Financial Assets) and FinCEN Form 114 (Report of Foreign Bank and Financial Accounts). Failure to report foreign income can result in severe penalties, so it’s crucial to stay informed and comply with reporting requirements.

Tax-Efficient Investment Strategies

When it comes to investing, minimizing tax implications is crucial for maximizing returns. By strategically structuring your investments, you can reduce the amount of taxes you pay and keep more of your hard-earned money. One key strategy to achieve this is through tax-loss harvesting, where you strategically sell investments at a loss to offset gains and reduce your tax liability. Additionally, investing in tax-efficient vehicles can help you optimize your portfolio for tax savings.

Structuring Investments for Tax Efficiency

- Utilize tax-advantaged accounts such as IRAs and 401(k)s to defer or avoid taxes on investment gains.

- Diversify your investments to include a mix of taxable and tax-advantaged assets to minimize overall tax impact.

- Consider holding investments for the long term to benefit from lower capital gains tax rates.

Tax-Loss Harvesting

- Identify investments with unrealized losses and strategically sell them to offset capital gains and reduce taxable income.

- Reinvest the proceeds from tax-loss harvesting into similar but not identical investments to maintain market exposure.

- Be mindful of the wash-sale rule, which prohibits repurchasing the same investment within 30 days of selling it for a loss.

Tax-Efficient Investment Vehicles

- Invest in index funds or ETFs, which typically have lower turnover and capital gains distributions compared to actively managed funds.

- Consider municipal bonds, which are often exempt from federal and sometimes state income taxes, providing tax-free income.

- Explore tax-managed mutual funds, which aim to minimize taxable distributions to investors by actively managing the fund’s portfolio.