Buckle up, because we’re about to dive into the world of tax filing! Get ready to navigate through the intricate process of taxes with our guide on How to File Taxes, filled with tips, tricks, and everything you need to know to stay ahead of the game.

From understanding the basics to maximizing deductions, this guide will equip you with the knowledge to conquer tax season like a pro.

Understanding Tax Filing

Tax filing is the process where individuals or businesses report their income, expenses, and other financial information to the government. This is typically done annually to calculate the amount of taxes owed or to receive a refund if too much tax was withheld throughout the year.

Filing taxes is important because it ensures that individuals and businesses comply with the law and contribute their fair share to public services. It also allows the government to collect the necessary funds to operate and provide essential services like infrastructure, education, and healthcare.

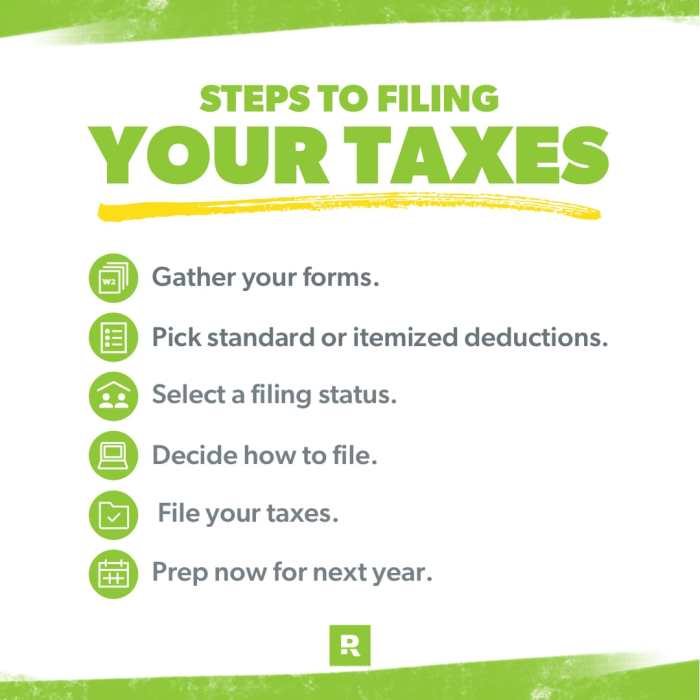

Tax Filing Process Overview

- Gather necessary documents such as W-2 forms, 1099s, receipts, and other financial records.

- Choose the appropriate tax form based on your filing status and income sources (e.g., 1040, 1040A, 1040EZ).

- Report your income, deductions, credits, and other relevant information on the tax form.

- Calculate the total tax owed or refund due based on the information provided.

- Submit your completed tax return to the IRS either electronically or through mail.

- Wait for confirmation of acceptance and any further communication from the IRS regarding your tax return.

Gathering Required Documents

When it comes to filing taxes, having the right documents is crucial to ensure accuracy and compliance with tax laws. Here, we will discuss the essential documents needed for the tax filing process.

W-2 Forms

- Your W-2 form is provided by your employer and Artikels the wages you earned during the tax year.

- It includes information on federal, state, and other taxes withheld from your paycheck.

- You can obtain your W-2 form from your employer by the end of January each year.

1099 Forms

- 1099 forms are used to report income from sources other than an employer, such as freelance work or investments.

- There are different types of 1099 forms, such as 1099-MISC for miscellaneous income and 1099-INT for interest income.

- You may receive 1099 forms from clients, financial institutions, or other entities that paid you during the tax year.

Additional Documents

- Other important documents include receipts for deductible expenses, such as medical bills, charitable donations, and business expenses.

- Keep records of any tax-related correspondence, such as letters from the IRS or state tax authorities.

- Having these documents on hand will help you accurately report your income and deductions when filing taxes.

Choosing the Right Tax Form

When it comes to filing your taxes, choosing the right tax form is crucial to ensure accuracy and efficiency. Understanding the different types of tax forms available and how to determine which one to use based on your individual circumstances can help streamline the process and avoid potential errors.

Types of Tax Forms

- The 1040 form: This is the standard form used for individual income tax returns. It allows you to report all types of income, deductions, and credits.

- The 1040A form: A shorter version of the 1040 form, the 1040A is designed for individuals with less complex tax situations. It has limitations on the types of income and deductions you can claim.

- The 1040EZ form: The simplest form of the three, the 1040EZ is for individuals with very straightforward tax situations. It has strict eligibility requirements and fewer options for deductions and credits.

Determining the Right Form

- If you have a simple tax situation with no dependents, limited income sources, and no itemized deductions, the 1040EZ form may be the best choice.

- For individuals with slightly more complex tax situations, such as dependents or itemized deductions, the 1040A form could be more suitable.

- If you have a more intricate tax situation involving various income sources, deductions, and credits, the standard 1040 form is likely the most appropriate option.

Examples of Common Scenarios

- Scenario 1: John is a single individual with one job and no dependents. He can use the 1040EZ form to file his taxes efficiently.

- Scenario 2: Sarah is married with children and has multiple income sources. She will need to use the 1040 form to accurately report her income, deductions, and credits.

- Scenario 3: Mark is a student with limited income and no dependents. He qualifies to use the 1040A form, which simplifies the filing process for him.

Deductions and Credits

Tax deductions and credits are essential components of the tax filing process that can help taxpayers reduce their taxable income and overall tax liability. While both deductions and credits can lower the amount of tax owed, they work in different ways.

Tax Deductions

Tax deductions are expenses that taxpayers can subtract from their gross income, reducing the amount of income that is subject to taxation. Common deductions include:

- Mortgage interest

- Charitable contributions

- Medical expenses

- Educational expenses

Tax Credits

Tax credits, on the other hand, directly reduce the amount of tax owed. They are typically more valuable than deductions as they provide a dollar-for-dollar reduction in the tax bill. Common tax credits include:

- Child Tax Credit

- Earned Income Tax Credit

- American Opportunity Credit

- Savers Tax Credit

Filing Options

When it comes to filing your taxes, there are several options available to choose from. Each method has its own pros and cons, so it’s important to consider your individual preferences and tax situation before deciding which one is right for you.

Online Filing

- Pros: Convenient, fast, and secure. Many online platforms offer step-by-step guidance and automatic calculations.

- Cons: May not be suitable for complex tax situations or those who prefer face-to-face interactions.

Tax Software

- Pros: Allows you to file your taxes from the comfort of your own home. Some software programs offer additional features like audit support.

- Cons: Cost may vary depending on the software package you choose. Not ideal for those who are not comfortable using technology.

Hiring a Professional

- Pros: Provides expert advice and guidance, especially for complex tax situations. Can help maximize deductions and credits.

- Cons: Cost can be higher compared to other filing options. Requires scheduling an appointment and providing all necessary documents.

Choosing the Best Option

When deciding on the best filing option for you, consider factors such as your comfort level with technology, the complexity of your tax situation, and your budget. If you have a straightforward tax return and are comfortable using online platforms, filing online may be the most cost-effective option. However, if you have a complex tax situation or prefer personalized assistance, hiring a professional may be the way to go. Ultimately, the best filing option is the one that meets your needs and helps you accurately file your taxes.

Deadline and Extensions

When it comes to filing your taxes, it’s crucial to be aware of the deadline to avoid any penalties. The tax filing deadline in the United States is typically April 15th each year. This means you need to submit your tax return by that date to stay compliant with the IRS.

Requesting an Extension

If for some reason you can’t file your taxes by the deadline, you can request an extension. The IRS allows taxpayers to file for an extension, giving them an additional six months to complete and submit their tax return. To request an extension, you need to fill out Form 4868 and submit it by the original tax filing deadline.

Penalties for Filing Taxes Late

Failing to file your taxes on time can lead to penalties imposed by the IRS. If you miss the tax filing deadline and didn’t request an extension, you may face penalties for late filing. The penalty is usually 5% of the unpaid taxes for each month your return is late, up to a maximum of 25% of your unpaid taxes.

It’s important to file your taxes on time to avoid penalties and any additional stress.

Tax Refunds

When you file your taxes and end up paying more than what you owe, the government returns the excess amount back to you. This is known as a tax refund.

Tracking Your Tax Refund

- Once you’ve filed your taxes, you can track the status of your tax refund through the IRS website or by using the IRS2Go app on your mobile device.

- Provide your Social Security number, filing status, and the exact amount of your refund to get real-time updates on where your refund stands.

- Typically, it takes about 24 hours after e-filing or four weeks after mailing your return to start tracking your refund.

Common Reasons for Delayed Tax Refunds

- Errors on your tax return, such as incorrect personal information or math mistakes, can delay your refund.

- Filing a paper return instead of e-filing can slow down the processing time and ultimately delay your refund.

- Claiming certain tax credits or deductions that require additional verification by the IRS can also cause delays in receiving your refund.

- If you owe back taxes, child support, or other federal debts, the IRS may withhold part or all of your refund to offset these obligations.

- Identity theft or fraud issues can lead to a hold on your refund until the IRS can confirm your identity and ensure the return is legitimate.