When it comes to managing your finances, understanding your net worth is key. From deciphering the difference between assets and liabilities to crunching the numbers, calculating your net worth can provide valuable insights into your financial health. Let’s dive into the nitty-gritty of how to calculate net worth and why it matters.

Overview of Net Worth Calculation

Net worth is a financial metric that represents the difference between a person’s assets (what they own) and liabilities (what they owe). It is an important indicator of an individual’s financial health and can help in assessing overall wealth.

Components of Net Worth

Calculating net worth involves taking into account various components that contribute to the overall financial picture. These components include:

- Assets: These are items of value that a person owns, such as cash, investments, real estate, vehicles, and personal belongings.

- Liabilities: These are debts and financial obligations that a person owes, such as mortgages, car loans, credit card debt, and student loans.

Using Net Worth as a Financial Indicator

Net worth serves as a key financial indicator that can provide insights into an individual’s financial standing and progress towards financial goals. It can help in:

- Evaluating financial health: A positive net worth indicates that assets exceed liabilities, while a negative net worth signals the opposite.

- Setting financial goals: Monitoring net worth over time can help in setting realistic financial goals and tracking progress towards achieving them.

- Planning for the future: Understanding net worth can assist in making informed decisions about investments, savings, and debt management.

Assets and Liabilities

In understanding how to calculate net worth, it is crucial to differentiate between assets and liabilities. Assets refer to items of value that an individual or entity owns, which can include cash, investments, real estate, vehicles, and valuable possessions. On the other hand, liabilities are debts or financial obligations that need to be repaid, such as mortgages, loans, credit card balances, and other outstanding payments.

Examples of Assets and Liabilities

- Assets:

- Cash in bank accounts

- Investment portfolios

- Real estate properties

- Stocks and bonds

- Retirement accounts

- Liabilities:

- Mortgages

- Car loans

- Credit card debt

- Student loans

- Personal loans

How Assets and Liabilities Determine Net Worth

Assets and liabilities play a vital role in determining an individual’s or organization’s net worth. The net worth is calculated by subtracting the total liabilities from the total assets. Essentially, net worth represents the difference between what is owned (assets) and what is owed (liabilities). By understanding and managing assets and liabilities effectively, one can improve their overall financial health and increase their net worth over time.

Calculating Net Worth

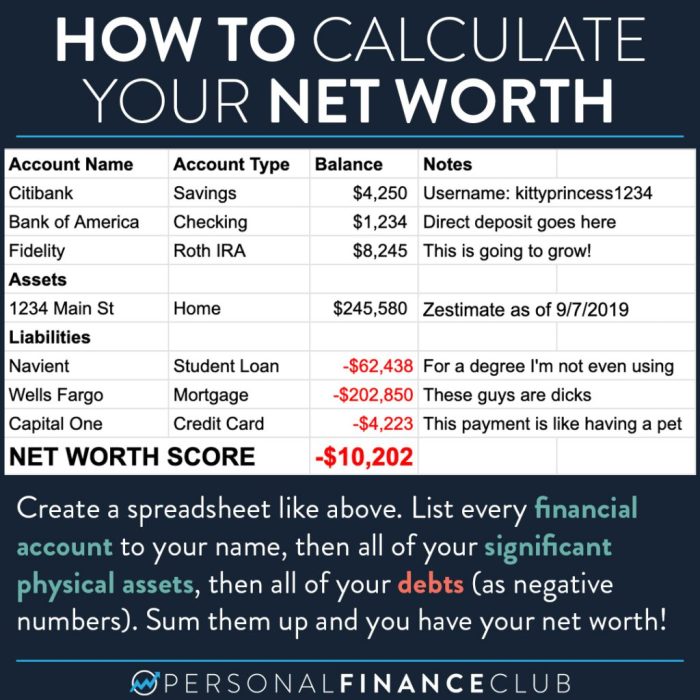

When it comes to determining your net worth, it’s all about understanding the value of what you own versus what you owe. By following a simple formula and accurately valuing your assets and liabilities, you can get a clear picture of your financial standing.

Formula for Calculating Net Worth

Net Worth = Assets – Liabilities

Calculating your net worth is a matter of subtracting your total liabilities from your total assets. This gives you a snapshot of your overall financial health and can help you track your progress over time.

Importance of Accurate Valuation of Assets and Liabilities

Accurately valuing your assets and liabilities is crucial for an honest assessment of your net worth. Inflating the value of your assets or underestimating your liabilities can give you a false sense of security or lead to financial mismanagement.

- Regularly update the value of your assets, such as real estate, investments, and personal property, to reflect their current market worth.

- Be thorough in listing all your liabilities, including debts, mortgages, and other financial obligations, to ensure an accurate calculation.

Gathering Necessary Information for the Calculation

Before you can calculate your net worth, you’ll need to gather all the relevant information about your assets and liabilities. This includes:

- Bank statements, investment account summaries, and retirement account balances for your assets.

- Credit card statements, loan balances, and mortgage details for your liabilities.

- Appraisals or market assessments for valuable assets like real estate or collectibles.

Common Mistakes in Net Worth Calculation

When calculating net worth, it’s crucial to avoid common mistakes that can lead to inaccurate results. These errors can impact your overall financial assessment and potentially misguide your financial decisions. Here are some common mistakes to watch out for and tips on how to avoid them for a more precise net worth evaluation.

Overlooking Assets or Liabilities

- One common mistake is overlooking certain assets or liabilities when calculating net worth. This can result in an inaccurate representation of your true financial standing.

- Ensure you consider all assets, including savings, investments, properties, and valuable possessions. Similarly, don’t forget to include all liabilities such as loans, mortgages, and credit card debt.

- Tip: Create a comprehensive list of all your assets and liabilities to ensure nothing is left out during the calculation process.

Incorrect Valuation of Assets

- Inaccurately valuing assets can skew your net worth calculation. Overestimating or underestimating the value of assets can significantly impact the final result.

- When valuing assets such as real estate or investments, use current market values rather than outdated estimates to ensure accuracy.

- Tip: Regularly update the value of your assets to reflect any changes in market conditions and ensure a more precise net worth assessment.

Ignoring Future Financial Obligations

- Another mistake is ignoring future financial obligations when calculating net worth. Failing to consider upcoming expenses or debts can provide a misleading picture of your financial health.

- Be sure to account for future financial commitments, such as loan repayments, taxes, or planned expenses, to get a more holistic view of your net worth.

- Tip: Include future financial obligations in your net worth calculation to better prepare for upcoming financial responsibilities and avoid any surprises.