Home loan refinancing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of home loan refinancing, where opportunities for saving and financial growth await those who dare to explore this dynamic landscape.

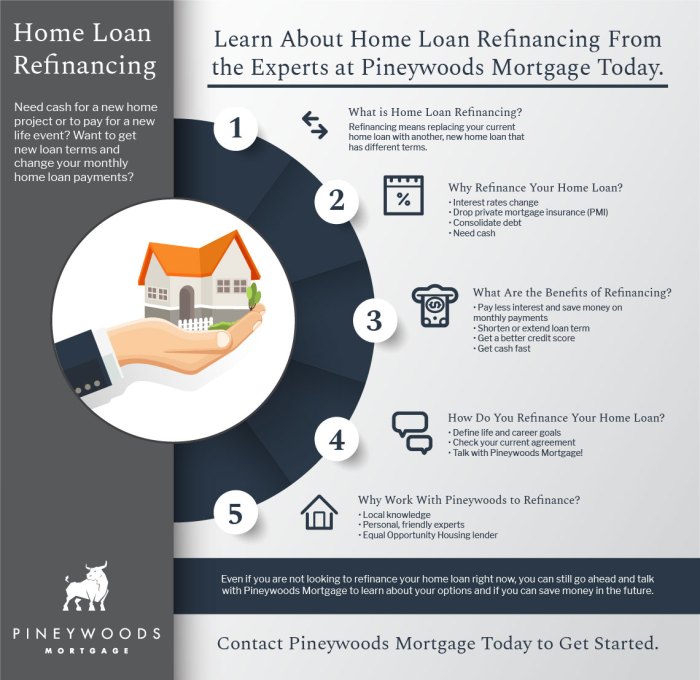

Overview of Home Loan Refinancing

Home loan refinancing is the process of replacing an existing mortgage with a new one, usually with better terms and conditions. This can help homeowners save money, lower their monthly payments, or access equity in their homes.

Benefits of Refinancing a Home Loan

- Lower Interest Rates: Refinancing can help secure a lower interest rate, reducing overall interest costs over the life of the loan.

- Lower Monthly Payments: By extending the loan term or securing a lower interest rate, homeowners can lower their monthly mortgage payments.

- Access Equity: Refinancing allows homeowners to tap into the equity built up in their homes, providing funds for home improvements, debt consolidation, or other financial needs.

- Change Loan Terms: Homeowners can switch from an adjustable-rate mortgage to a fixed-rate mortgage or vice versa, depending on their financial goals and circumstances.

Reasons for Refinancing a Home Loan

- Reduce Monthly Payments: Many homeowners refinance to secure a lower interest rate and lower their monthly mortgage payments.

- Access Cash: Refinancing can provide homeowners with access to cash for major expenses or investments.

- Consolidate Debt: By refinancing, homeowners can consolidate high-interest debt into their mortgage, potentially saving money on interest payments.

- Change Loan Terms: Some homeowners refinance to change the length of their loan term or switch between fixed and adjustable-rate mortgages.

Common Misconceptions about Home Loan Refinancing

- Refinancing is Expensive: While there are closing costs associated with refinancing, the long-term savings can outweigh these initial expenses.

- It’s Only for Lowering Interest Rates: Refinancing can offer a range of benefits beyond just lowering interest rates, such as accessing equity or changing loan terms.

- It Harms Credit Score: Refinancing typically has a minimal impact on credit scores, especially if managed responsibly.

- It’s Too Complicated: While the process may seem daunting, many lenders offer streamlined refinancing options to simplify the process for homeowners.

Factors to Consider Before Refinancing

Before deciding to refinance your home loan, there are several key factors to consider that can have a significant impact on your financial situation.

Credit Score

Your credit score plays a crucial role in determining whether you qualify for a better interest rate when refinancing. Lenders typically offer lower rates to borrowers with higher credit scores, so it’s important to ensure your score is in good shape before applying for a refinance.

Interest Rates

The current interest rates in the market should also be a major consideration when thinking about refinancing. If rates are significantly lower than what you’re currently paying on your mortgage, it may be a good time to refinance and potentially save money over the life of the loan.

Loan Terms

Different loan terms, such as a 15-year or 30-year mortgage, can have varying implications on refinancing. Shorter loan terms typically come with lower interest rates but higher monthly payments, while longer terms may have higher rates but lower monthly payments. Consider how changing your loan term could impact your overall financial goals before refinancing.

Process of Refinancing a Home Loan

Refinancing a home loan involves several steps that borrowers need to follow to secure a new loan with better terms. It’s essential to be well-prepared and organized throughout the process to ensure a successful refinancing experience.

Steps Involved in Refinancing a Home Loan

- Evaluate Your Current Loan: Take a close look at your existing home loan terms, interest rate, monthly payments, and remaining balance.

- Check Your Credit Score: A good credit score can help you qualify for better refinancing options and lower interest rates.

- Shop Around for Lenders: Compare offers from different lenders to find the best refinancing deal that suits your financial goals.

- Submit an Application: Once you’ve chosen a lender, complete the application process by providing necessary documentation and information.

- Appraisal and Underwriting: The lender will conduct a home appraisal to determine the property’s value and review your application for approval.

- Closing: Sign the new loan documents, pay any closing costs, and officially close the refinancing process.

Tips for Preparing to Refinance a Home Loan

- Improve Your Credit Score: Pay off outstanding debts and maintain a good credit history to increase your chances of qualifying for better refinancing terms.

- Research Lenders: Compare rates, fees, and customer reviews from different lenders to choose the best option for your financial situation.

- Gather Necessary Documents: Prepare essential documentation such as pay stubs, tax returns, and bank statements to streamline the application process.

- Calculate Costs: Evaluate closing costs, loan terms, and potential savings to ensure that refinancing makes financial sense for you.

Documentation Required for the Refinancing Process

- Proof of Income: Pay stubs, W-2 forms, tax returns, and other income-related documents.

- Asset Verification: Bank statements, investment accounts, and other assets that can support your loan application.

- Property Information: Home appraisal reports, insurance policies, and other property-related documents.

- Credit History: Credit reports, scores, and any information related to your creditworthiness.

Timeline of a Typical Home Loan Refinancing Process

On average, the refinancing process can take anywhere from 30 to 45 days, depending on the lender’s efficiency, the complexity of your application, and other external factors.

Types of Home Loan Refinancing

When it comes to refinancing your home loan, there are several options to consider based on your financial goals and current situation. Let’s explore the different types of home loan refinancing available to borrowers.

Rate-and-Term Refinancing vs. Cash-Out Refinancing

Rate-and-term refinancing involves replacing your existing mortgage with a new one that has better terms, such as a lower interest rate or shorter repayment period. On the other hand, cash-out refinancing allows you to borrow more than your current mortgage balance and receive the difference in cash. While rate-and-term refinancing can help you save money on interest over time, cash-out refinancing can provide funds for home improvements, debt consolidation, or other expenses.

Fixed-Rate vs. Adjustable-Rate Refinancing Options

With fixed-rate refinancing, your interest rate remains the same throughout the life of the loan, providing stability and predictability in your monthly payments. In contrast, adjustable-rate refinancing offers an initial lower interest rate that can fluctuate periodically based on market conditions. Choosing between the two depends on your risk tolerance and financial objectives.

Government-Backed Refinancing Programs

Government-backed refinancing programs, such as FHA and VA loans, are designed to help borrowers with limited credit or low down payments. FHA loans are insured by the Federal Housing Administration and often require lower credit scores and down payments, while VA loans are guaranteed by the Department of Veterans Affairs and are available to eligible veterans and active-duty service members. These programs can provide attractive refinancing options for those who qualify.

Situations Where Each Type of Refinancing is Suitable

– Rate-and-term refinancing is suitable for borrowers looking to reduce their monthly payments or pay off their mortgage faster.

– Cash-out refinancing is ideal for homeowners who need extra funds for major expenses like home renovations or debt consolidation.

– Fixed-rate refinancing is recommended for borrowers seeking predictability and stability in their mortgage payments.

– Adjustable-rate refinancing may be beneficial for those planning to sell or refinance their home within a few years.

– Government-backed refinancing programs are suitable for borrowers with limited credit history or low down payment capabilities.