Get ready to dive into the world of Financial Planning for Retirement. As we explore the ins and outs of securing your financial future, prepare to be amazed by the strategies and insights that can help you retire in style.

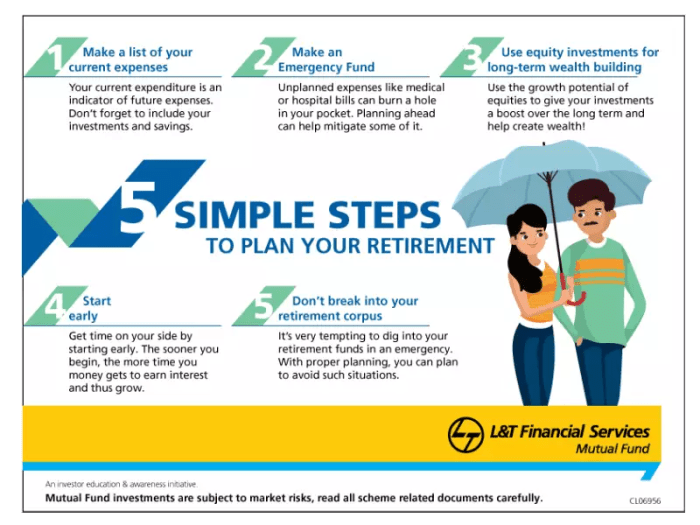

In this guide, we’ll break down the key components of a solid retirement plan and highlight the importance of early planning to ensure a stress-free retirement.

Importance of Financial Planning for Retirement

Financial planning for retirement is crucial for ensuring a secure and comfortable future. Without proper planning, individuals may face financial hardships during their retirement years, leading to a diminished quality of life. It is essential to start planning early to build a substantial nest egg that can support you throughout your retirement.

Benefits of Starting Retirement Planning Early

- Compound Interest: Starting early allows your investments to benefit from compounding, resulting in significant growth over time.

- Time to Recover from Losses: By starting early, you have more time to recover from any potential investment losses, reducing the impact on your retirement savings.

- Lower Required Savings Rate: Starting early means you can save smaller amounts each month to reach your retirement goals, making it more manageable.

Statistics on Retirement Preparedness

According to a survey by the Employee Benefit Research Institute, only 42% of Americans have calculated how much they need to save for retirement.

Another study found that 1 in 4 Americans have less than $1,000 saved for retirement.

Components of a Solid Retirement Plan

Planning for retirement involves several key components that are essential for a secure financial future. Let’s explore some of the key elements that should be included in a well-rounded retirement plan.

Investments in a Retirement Portfolio

- Diversification: A solid retirement plan should include a diverse range of investments to spread risk and maximize returns. This can include stocks, bonds, real estate, and other assets.

- Asset Allocation: Allocating your investments based on your risk tolerance, time horizon, and financial goals is crucial. A mix of assets can help balance risk and return.

- Regular Review: It’s important to regularly review and adjust your investment portfolio as needed to ensure it aligns with your retirement goals and risk tolerance.

Consideration of Healthcare Costs

Healthcare costs can be a significant expense in retirement, so it’s crucial to factor them into your retirement planning. Here are some key points to consider:

- Medicare Coverage: Understanding how Medicare works and what it covers can help you plan for out-of-pocket expenses that may not be covered.

- Long-Term Care: Long-term care costs can be substantial, so having a plan in place to cover these expenses is important. This may include long-term care insurance or other strategies.

- Health Savings Accounts (HSAs): Utilizing HSAs can help you save for healthcare expenses in retirement tax-free, providing a valuable resource for managing healthcare costs.

Retirement Savings Strategies

When it comes to planning for retirement, having a solid savings strategy in place is essential. By exploring different retirement savings vehicles and understanding how to maximize contributions, you can set yourself up for a comfortable retirement. Let’s dive into some key strategies to consider.

Comparison of Retirement Savings Vehicles

- 401(k): A 401(k) is a retirement account offered by many employers, allowing employees to contribute a portion of their pre-tax income. Some employers even match a percentage of these contributions, providing a valuable opportunity for retirement savings growth.

- IRAs: Individual Retirement Accounts (IRAs) are another popular option for saving for retirement. There are different types of IRAs, including Traditional IRAs and Roth IRAs, each with unique tax advantages and contribution limits.

- Pensions: Pensions are retirement plans provided by some employers, where employees receive a set amount of income during retirement based on their years of service and salary. While less common today, pensions can still offer a reliable source of retirement income.

Maximizing Contributions to Retirement Accounts

- Take advantage of employer matching: If your employer offers a 401(k) match, be sure to contribute enough to maximize this benefit. It’s essentially free money that can significantly boost your retirement savings.

- Contribute consistently: Aim to contribute a set amount to your retirement accounts each month. Consistent contributions can help your savings grow over time, thanks to compound interest.

- Utilize catch-up contributions: As you near retirement age, you may be eligible to make additional catch-up contributions to your retirement accounts. Take advantage of these opportunities to boost your savings in the final years before retirement.

Diversification in Retirement Savings

- Diversification is key in retirement savings to reduce risk and maximize returns. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can help protect your savings from market fluctuations.

- Consider target-date funds: Target-date funds automatically adjust the asset allocation in your retirement portfolio based on your projected retirement date. These funds offer a convenient way to achieve diversification without the need for constant monitoring and rebalancing.

- Regularly review and adjust your portfolio: It’s important to regularly review your retirement portfolio and make adjustments as needed based on your risk tolerance, timeline to retirement, and financial goals. This proactive approach can help ensure your savings are on track for a secure retirement.

Retirement Income Sources

Planning for retirement involves understanding the various potential sources of income that you can rely on once you stop working. These income sources typically include Social Security, pensions, and personal savings. Each of these sources has its own set of pros and cons that need to be carefully considered in order to create a reliable income stream during retirement.

Social Security

Social Security is a government program that provides a monthly income to retirees based on their earnings history. While it offers a guaranteed income for life and is adjusted for inflation, the amount you receive may not be enough to cover all your expenses in retirement.

Pensions

Pensions are retirement plans provided by some employers, where you receive a fixed amount of income each month after you retire. The advantage of pensions is the security of a steady income, but not all employers offer pensions nowadays, making them less common as a sole source of retirement income.

Personal Savings

Personal savings, such as 401(k) accounts, IRAs, and other investments, are another crucial source of retirement income. These accounts offer flexibility and control over your investments, but the onus is on you to manage and grow your savings to ensure they last throughout retirement.

Creating a Reliable Income Stream

To create a reliable income stream in retirement, it’s important to diversify your income sources. Relying on a combination of Social Security, pensions, and personal savings can help mitigate the risks associated with each individual source. Additionally, consider building an emergency fund to cover unexpected expenses and explore options like annuities or part-time work to supplement your income.