Diving into the world of ethical investing, get ready to explore the ins and outs of this dynamic financial strategy that’s all about making a positive impact. From ESG criteria to success stories, this journey will open your eyes to a whole new way of investing.

Get ready to uncover the secrets behind ethical investing and how it’s shaping the future of finance.

What is Ethical Investing?

Ethical investing, also known as socially responsible investing (SRI), is an investment strategy that considers both financial return and social/environmental good. It involves selecting companies or funds that align with the investor’s values and ethical beliefs.

Ethical investing focuses on companies that operate in a sustainable and responsible manner, promoting positive social change and environmental practices. This type of investing seeks to support businesses that contribute to a better world while avoiding those that engage in unethical practices such as environmental damage, human rights violations, or unfair labor practices.

Importance of Ethical Investing

Ethical investing is becoming increasingly important in today’s financial landscape as investors are more conscious of the impact their investments have on the world. By investing ethically, individuals can support companies that are working towards a sustainable future and make a positive difference in society.

- Investing in companies that prioritize environmental sustainability can help combat climate change and promote a cleaner, greener future.

- Supporting businesses with strong ethical practices can lead to better corporate governance and accountability, reducing the risk of scandals and controversies.

- Ethical investing can align with personal values and beliefs, providing a sense of purpose and fulfillment beyond financial gain.

Examples of Companies in Ethical Investing

- Renewable energy companies like Tesla and SolarCity are commonly associated with ethical investing due to their focus on clean energy and reducing carbon emissions.

- Socially responsible mutual funds such as the Calvert Impact Capital and Pax World Funds prioritize investments in companies with strong environmental, social, and governance (ESG) practices.

- Companies with fair labor practices and diversity initiatives, such as Patagonia and Ben & Jerry’s, are often favored by ethical investors for their commitment to social responsibility.

Types of Ethical Investing

When it comes to ethical investing, there are several approaches that investors can take to align their values with their financial goals. Some of the key types of ethical investing include ESG criteria, impact investing, and socially responsible investing (SRI).

ESG (Environmental, Social, and Governance) Criteria

ESG criteria involve evaluating companies based on their environmental impact, social responsibility, and governance practices. This approach looks at how companies manage their environmental risks, treat their employees and communities, and maintain strong corporate governance. Investors who focus on ESG criteria aim to support companies that are making positive contributions to society while minimizing negative impacts.

Impact Investing

Impact investing goes beyond just avoiding harmful companies and seeks to actively invest in businesses and projects that generate positive social or environmental impact. This approach involves allocating capital to organizations that are working to address pressing issues like climate change, poverty, or healthcare access. Impact investors aim to drive measurable, beneficial outcomes alongside financial returns.

Socially Responsible Investing (SRI)

Socially responsible investing (SRI) involves screening investments based on specific ethical guidelines or values. This may include avoiding industries like tobacco, firearms, or gambling, or supporting companies with strong diversity and inclusion policies. SRI investors seek to align their portfolios with their personal values and beliefs, making decisions that reflect their commitment to social and environmental responsibility.

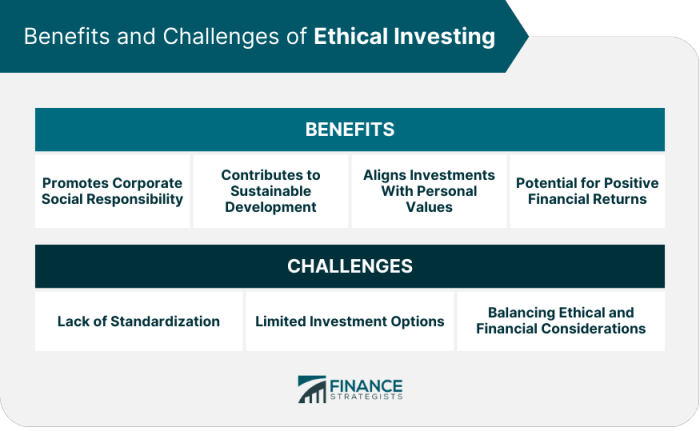

Benefits of Ethical Investing

Investing ethically comes with a variety of benefits that extend beyond just financial returns. Ethical investing allows investors to align their values with their investment choices, supporting companies that prioritize social and environmental responsibility. This not only benefits the investors themselves but also has a positive impact on companies and society as a whole.

Positive Impact on Companies

Ethical investing encourages companies to adopt sustainable practices, improve transparency, and prioritize social responsibility. By attracting ethical investors, companies are motivated to operate in an environmentally and socially conscious manner, leading to long-term growth and stability.

Enhanced Reputation

Companies that engage in ethical practices and are supported by ethical investors tend to have a positive reputation in the market. This can lead to increased consumer trust, brand loyalty, and overall competitiveness in the industry.

Driving Positive Change

Ethical investing plays a key role in driving positive change in corporate behavior and policies. By directing capital towards companies that uphold ethical standards, investors can influence decision-making processes and push for more responsible practices across various industries.

Success Stories

One notable success story in ethical investing is the rise of impact investing, where investors seek to generate positive social and environmental impact alongside financial returns. This approach has led to the funding of innovative solutions to global challenges, such as renewable energy projects and sustainable agriculture initiatives.

Long-Term Sustainability

Ethical investing promotes long-term sustainability by encouraging companies to consider the impact of their actions on the environment, society, and future generations. This focus on sustainable practices helps create a more resilient and responsible business ecosystem.

Challenges and Criticisms of Ethical Investing

Ethical investing, while noble in its intentions, faces several challenges and criticisms in the financial world.

Limited Investment Options and Lower Returns

Ethical investors often face limited choices when it comes to investing in companies that align with their values. This can lead to a lack of diversification in their portfolios, potentially exposing them to higher risks. Additionally, some ethical investment options may offer lower returns compared to traditional investments, making it challenging for investors to achieve competitive financial gains.

Criticisms of Greenwashing and Superficial Commitment

One of the main criticisms of ethical investing is the concept of greenwashing, where companies portray themselves as environmentally friendly or socially responsible without actually implementing substantial changes. This can mislead investors who are looking to support genuinely ethical businesses. Critics also argue that some companies engage in ethical practices only on the surface level to attract socially conscious investors, without making meaningful long-term commitments.

Examples of Ethical Investing Controversies

In the past, there have been instances where companies involved in ethical investing faced controversies due to their questionable practices. One notable example is the case of a company that claimed to be eco-friendly but was found to have violated environmental regulations. In response, ethical investors demanded transparency and accountability from the company, leading to increased scrutiny and the implementation of stricter sustainability measures.

How to Start Ethical Investing

To begin your journey into ethical investing, there are several steps you can take to get started. By following these steps, you can ensure that your investments align with your values and contribute to positive change in the world.

Research and Education

- Start by educating yourself on the concept of ethical investing and the different approaches available. Understand the various criteria used to evaluate companies and industries from an ethical standpoint.

- Utilize online resources such as ethical investing websites, blogs, and forums to stay informed about the latest trends and opportunities in the field.

- Consider taking a course or workshop on ethical investing to deepen your knowledge and expertise in this area.

Selecting Ethical Investment Opportunities

- Use screening tools and platforms that specialize in ethical investing to identify companies that meet your ethical criteria. Look for companies with strong environmental, social, and governance (ESG) practices.

- Consult with financial advisors or experts who specialize in ethical investing to help you navigate the selection process and choose investments that align with your values.

- Explore ethical mutual funds, exchange-traded funds (ETFs), and impact investing options as vehicles for your ethical investments.

Building an Ethical Investment Portfolio

- Diversify your portfolio by investing in a mix of asset classes and industries to spread risk and maximize returns while staying true to your ethical values.

- Regularly review and monitor your investments to ensure they continue to meet your ethical standards and financial goals. Consider rebalancing your portfolio as needed.

- Stay engaged with the companies you invest in by exercising your shareholder rights and advocating for positive change through active ownership.