Welcome to the world of annuities, where financial planning meets long-term security. In this guide, we’ll dive into the intricate world of annuities, unraveling their complexities and shedding light on how they can shape your financial future.

What are Annuities?

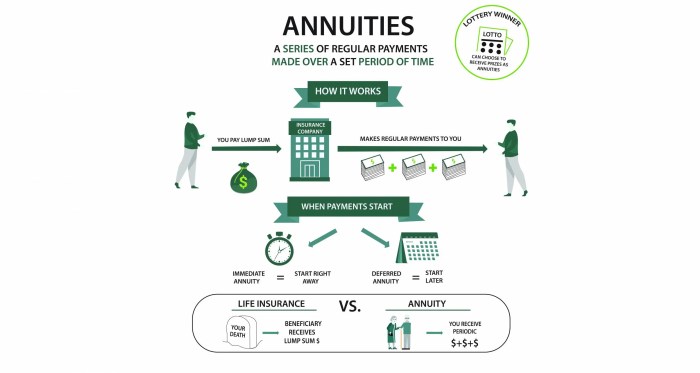

Annuities are financial products designed to provide a steady stream of income for a specified period or for life. They are typically purchased from insurance companies and can be used as part of retirement planning or to receive regular payments over time.

Types of Annuities

Annuities come in various forms, including:

- Fixed Annuities: Offer a guaranteed interest rate for a specific time period.

- Variable Annuities: Allow the holder to invest in different sub-accounts, with returns based on market performance.

- Indexed Annuities: Tie returns to a stock market index, offering the potential for higher returns.

Purpose of Annuities in Financial Planning

Annuities serve several purposes in financial planning, such as:

- Creating a steady income stream during retirement.

- Providing tax-deferred growth on investments.

- Offering a way to pass on assets to beneficiaries.

Types of Annuities

When it comes to annuities, there are three main types: fixed, variable, and indexed annuities. Each type offers different benefits and drawbacks, as well as varying payout structures.

Fixed Annuities

Fixed annuities provide a guaranteed payout amount over a specified period. The interest rate is predetermined and does not change, offering stability to the annuitant. While they provide a secure income stream, fixed annuities may not offer as high returns as other types.

Variable Annuities

Variable annuities allow the annuitant to invest in various sub-accounts, typically consisting of mutual funds. The payout amount fluctuates based on the performance of these investments. Variable annuities offer the potential for higher returns but also come with greater risk due to market fluctuations.

Indexed Annuities

Indexed annuities are tied to a specific market index, such as the S&P 500. They offer the opportunity for growth based on the performance of the index, while also providing a guaranteed minimum return. Indexed annuities strike a balance between fixed and variable annuities, offering some growth potential with downside protection.

Overall, the choice between fixed, variable, and indexed annuities depends on your risk tolerance, financial goals, and need for guaranteed income. It’s essential to carefully consider your options and consult with a financial advisor to determine the best type of annuity for your individual situation.

How Annuities Work

Annuities work in two main phases – the accumulation phase and the annuitization phase. Let’s break down each phase to understand how annuities operate.

Accumulation Phase

During the accumulation phase of an annuity, you contribute money to the annuity either through a lump sum payment or regular contributions over time. This phase is all about building up your investment and allowing it to grow through interest or investment returns. The money you contribute during this phase grows tax-deferred, meaning you don’t pay taxes on the earnings until you start receiving payments.

Annuitization Phase

Once you’re ready to start receiving income from your annuity, you enter the annuitization phase. This is when you convert your accumulated funds into a stream of income payments. You can choose from various annuity payout options, such as receiving payments for a set number of years or for the rest of your life. The amount you receive each period is determined by factors like the size of your account, your age, and the annuity’s terms.

Tax Implications of Annuities

When it comes to taxes, annuities have some unique considerations. While your contributions during the accumulation phase grow tax-deferred, the earnings you withdraw during the annuitization phase are taxed as ordinary income. It’s important to note that if you withdraw money from your annuity before age 59 1/2, you may face an additional 10% penalty on top of the regular income tax. However, some annuities offer penalty-free withdrawals for certain circumstances, so be sure to understand the terms of your specific annuity contract.

Annuity Fees and Charges

When it comes to annuities, understanding the fees and charges associated with them is crucial. These costs can significantly impact the overall performance of your investment. Let’s break down the common fees, their impact, and strategies to minimize them.

Common Fees Associated with Annuities

- Management Fees: These are charged by the insurance company for managing your annuity.

- Mortality and Expense Risk Fees: These cover the insurance company’s costs and risks.

- Administrative Fees: Charged for administrative tasks related to your annuity.

- Underlying Investment Fees: If your annuity is invested in mutual funds or other investments, you may incur additional fees.

How Fees Impact the Overall Performance

- High fees can eat into your returns over time, reducing the growth of your investment.

- Compounded over years, even seemingly small fees can result in significant losses.

- Understanding the impact of fees is crucial in evaluating the true value of an annuity.

Strategies to Minimize Fees

- Choose low-cost annuities with minimal fees to maximize your returns.

- Consider fee structures like fee-only annuities or fee-based annuities that are transparent about costs.

- Avoid unnecessary riders or add-ons that can increase fees without adding significant value.

Annuities vs. Other Retirement Plans

When comparing annuities with other retirement plans such as 401(k) plans and IRAs, it’s essential to understand the unique features and benefits each option offers. Let’s dive into the advantages and disadvantages of choosing an annuity over other retirement options and how annuities can complement existing retirement savings strategies.

Benefits of Annuities

- Annuities provide a guaranteed income stream for life, offering a sense of financial security during retirement.

- They have no contribution limits, allowing individuals to invest more for retirement compared to traditional retirement plans like IRAs.

- Some annuities offer tax-deferred growth, meaning you won’t have to pay taxes on your earnings until you start withdrawing funds.

Drawbacks of Annuities

- Annuities can come with high fees and charges, reducing the overall returns on investment.

- They lack liquidity, as withdrawing funds before a certain age can result in penalties and surrender charges.

- Complexity in understanding different types of annuities and their features can make it challenging for some individuals to choose the right option.

Complementing Retirement Savings Strategies

Annuities can be a valuable addition to your retirement savings strategy by providing a steady income stream in addition to other retirement accounts like 401(k) plans and IRAs. By diversifying your retirement portfolio with an annuity, you can ensure a mix of guaranteed income and market-based investments, balancing risk and security in your retirement planning.

Annuity Riders and Options

When it comes to annuities, riders can play a crucial role in customizing the policy to meet specific needs and financial goals. These optional features offer additional benefits or protections that can enhance the overall value of the annuity.

Common Riders Available for Annuities

- Guaranteed Minimum Income Benefit (GMIB): Provides a minimum level of income, regardless of market performance.

- Death Benefit Rider: Ensures a beneficiary receives a specified amount upon the annuitant’s death.

- Long-Term Care Rider: Allows for funds to be used for long-term care expenses if needed.

How Riders Customize Annuities

- Riders can add flexibility and protection to an annuity based on individual needs.

- They can help address concerns such as market volatility, longevity, or healthcare expenses.

- Choosing the right combination of riders can tailor the annuity to specific financial goals.

Selecting the Right Riders

- It’s essential to evaluate personal circumstances and financial objectives before selecting riders.

- Consider factors like risk tolerance, retirement timeline, and desired level of protection.

- Working with a financial advisor can help determine the most suitable riders for your situation.