Diving into the world of fixed-income investments, we embark on a journey filled with financial wisdom and strategic insights. Get ready to explore the intricacies of this investment option and discover the keys to maximizing your returns.

As we delve deeper, we’ll uncover the nuances of various fixed-income instruments and how they play a crucial role in shaping a well-rounded investment portfolio.

Overview of Fixed-Income Investments

Fixed-income investments are securities that pay investors fixed interest or dividend payments until maturity. These investments are considered less risky than stocks and are commonly used by investors seeking a steady income stream or capital preservation.

Types of Fixed-Income Investments

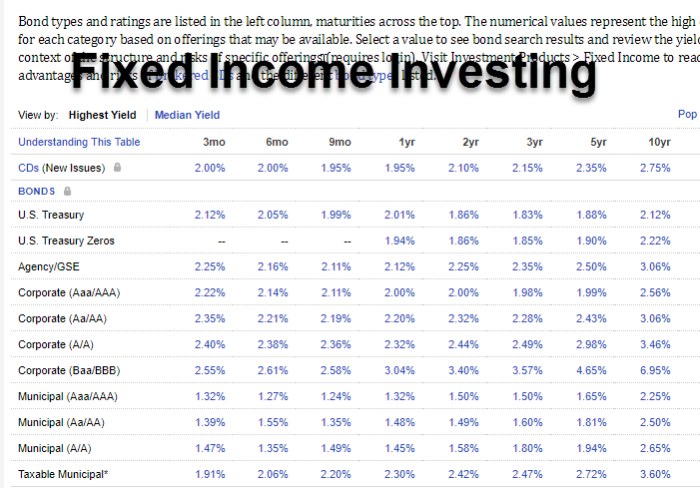

- 1. Bonds: Bonds are debt securities issued by governments, municipalities, or corporations. They pay a fixed interest rate and return the principal amount at maturity.

- 2. Treasury Securities: These are bonds issued by the U.S. government and are considered the safest fixed-income investments.

- 3. Certificates of Deposit (CDs): CDs are time deposits offered by banks with fixed interest rates and maturity dates.

- 4. Money Market Instruments: These include Treasury bills, commercial paper, and repurchase agreements, offering short-term fixed income.

Importance of Fixed-Income Investments in a Portfolio

Fixed-income investments play a crucial role in a diversified portfolio by providing stability and income. They can help balance the risk exposure of a portfolio heavily weighted in equities. Additionally, fixed-income investments can act as a hedge against market volatility and economic downturns.

Comparison with Other Investment Options

- Fixed-Income vs. Stocks: While stocks offer higher returns, fixed-income investments provide a more predictable income stream and lower volatility.

- Fixed-Income vs. Real Estate: Real estate investments can offer higher potential returns but come with higher risk and require active management.

- Fixed-Income vs. Commodities: Commodities can provide diversification but are subject to price fluctuations and market speculation.

Benefits of Fixed-Income Investments

Fixed-income investments offer a range of advantages for investors looking for stability and consistent returns in their portfolios. These investments provide a reliable income stream, act as a hedge against stock market volatility, and can outperform other asset classes in certain scenarios.

Steady Income Stream

Fixed-income investments, such as bonds or certificates of deposit, offer investors a predictable and steady stream of income through interest payments. This regular income can be especially beneficial for retirees or those looking to supplement their current income without taking on excessive risk.

Hedge Against Stock Market Volatility

During times of stock market turbulence or economic uncertainty, fixed-income investments can act as a safe haven for investors. The stable returns and low volatility of these investments can help cushion a portfolio from the ups and downs of the stock market, providing a sense of security and protection.

Outperforming Other Asset Classes

In certain market conditions, fixed-income investments have shown the ability to outperform other asset classes like stocks or real estate. For example, during periods of rising interest rates, bond prices can increase, leading to attractive returns for bond investors. Additionally, during economic downturns, the relative stability of fixed-income investments can help preserve capital when other investments may be experiencing significant losses.

Risks Associated with Fixed-Income Investments

Fixed-income investments, while offering stability and steady income, come with their own set of risks that investors need to be aware of in order to make informed decisions. Let’s delve into the key risks associated with fixed-income investments.

Interest Rate Risk

Interest rate risk is a significant factor to consider when investing in fixed-income securities. This risk arises from the inverse relationship between interest rates and bond prices. When interest rates rise, bond prices fall, leading to potential capital losses for investors holding fixed-rate bonds. Conversely, when interest rates decline, bond prices may increase, resulting in capital gains. Therefore, changes in interest rates can impact the value of fixed-income investments.

Credit Risk

Credit risk refers to the risk of default by the issuer of a bond or other fixed-income security. This risk is more prominent in lower-rated bonds or securities issued by companies with weaker financial positions. In the event of a default, investors may face partial or total loss of their investment. It is essential for investors to assess the creditworthiness of the issuer before investing in fixed-income securities to mitigate credit risk.

Liquidity Risk

Liquidity risk pertains to the ease of buying or selling fixed-income investments without significantly impacting their prices. Illiquid fixed-income securities may be challenging to sell quickly, especially during times of market stress, leading to potential losses for investors needing to liquidate their holdings. Investors should consider the liquidity of their fixed-income investments to ensure they can easily access their funds when needed.

Strategies for Investing in Fixed-Income Securities

Investing in fixed-income securities requires a strategic approach to maximize returns while managing risks effectively.

Building a Diversified Fixed-Income Portfolio

Building a diversified fixed-income portfolio is crucial to spread risk across different types of fixed-income securities. This can be achieved by investing in various asset classes such as government bonds, corporate bonds, municipal bonds, and mortgage-backed securities. Diversification helps reduce the impact of market fluctuations on your overall portfolio performance.

The Importance of Credit Quality in Fixed-Income Investments

Credit quality plays a significant role in determining the risk and return potential of fixed-income investments. Higher credit quality bonds typically offer lower yields but come with lower default risk. It’s essential to assess the credit ratings of bonds before investing to ensure the stability and safety of your investment portfolio.

Understanding Duration in Managing Fixed-Income Investments

Duration measures the sensitivity of a bond’s price to changes in interest rates. Bonds with longer durations are more sensitive to interest rate fluctuations, while those with shorter durations are less affected. Managing duration in your fixed-income portfolio can help mitigate interest rate risk and enhance overall portfolio performance.

Adjusting Investment Strategies Based on Economic Conditions

Economic conditions can have a significant impact on fixed-income investments. During periods of economic growth, investors may consider investing in corporate bonds for higher yields, while in times of economic uncertainty, shifting towards government bonds or high-quality securities may provide more stability. Adapting your investment strategies based on prevailing economic conditions can help optimize returns and minimize risks in your fixed-income portfolio.