Yo, diving into the world of investment risk management is crucial for anyone looking to secure that bag and build their wealth. Let’s break it down and see how managing risks can make or break your financial game.

Now, let’s get into the nitty-gritty details of different types of investment risks and how to handle them like a boss.

Importance of Investment Risk Management

Investment risk management is crucial for financial success as it helps investors protect their capital, maximize returns, and achieve their financial goals. By effectively managing risks, investors can minimize potential losses and uncertainties, resulting in a more stable and profitable investment portfolio.

Examples of Poor Risk Management

- Failure to diversify: Investing all funds in a single asset or sector can expose investors to significant risks if that particular investment underperforms or experiences a downturn.

- Ignoring market volatility: Failing to consider market fluctuations and economic trends can lead to losses when unexpected events impact investment performance.

- Overleveraging: Borrowing excessively to invest can amplify losses if investments do not perform as expected, leading to financial distress.

Role of Risk Tolerance

- Risk tolerance refers to an investor’s ability and willingness to withstand fluctuations in the value of their investments.

- Understanding one’s risk tolerance is crucial in making investment decisions, as it helps determine the appropriate level of risk to take on based on individual preferences and financial goals.

- Investors with a higher risk tolerance may be more comfortable with volatile investments, while those with a lower risk tolerance may prefer more stable assets to minimize potential losses.

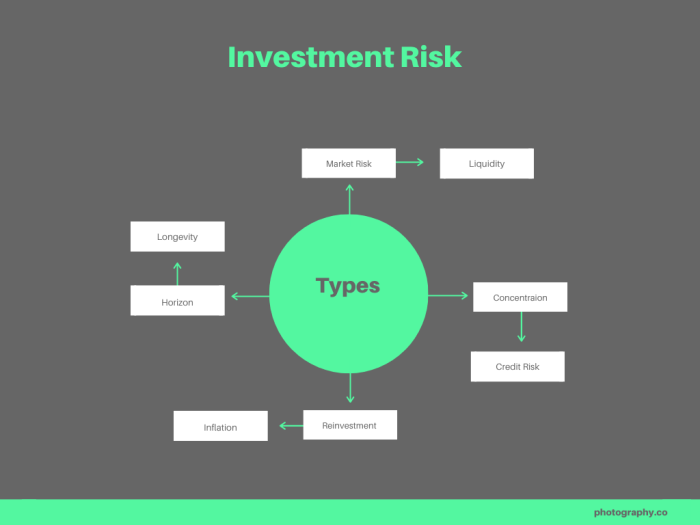

Types of Investment Risks

Investing always comes with risks, and being aware of the different types of risks is crucial for successful investment management. Let’s take a look at some common types of investment risks and how they can impact investment portfolios.

Market Risk

Market risk, also known as systematic risk, refers to the risk of investments losing value due to factors affecting the overall market. This includes economic downturns, geopolitical events, interest rate fluctuations, and market volatility. Market risk can lead to losses across a wide range of investments, impacting the entire portfolio. To mitigate market risk, diversification is key. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of market fluctuations on their portfolio.

Credit Risk

Credit risk is the risk of loss due to a borrower or issuer failing to meet their financial obligations. This risk is particularly relevant for investments in bonds or other debt securities. When a borrower defaults on their payments, investors may incur losses. To mitigate credit risk, investors can conduct thorough credit analysis before investing in bonds, choose investments with higher credit ratings, or consider investing in diversified bond funds.

Liquidity Risk

Liquidity risk refers to the risk of not being able to sell an investment quickly enough without significantly affecting its price. Illiquid investments, such as real estate or certain types of bonds, can pose liquidity risks. In times of market stress, illiquid investments may be challenging to sell at fair prices. To manage liquidity risk, investors should balance their portfolio with liquid assets that can be easily bought or sold in the market without causing major price disruptions.

Overall, understanding and effectively managing these types of investment risks are essential for building a resilient and successful investment portfolio.

Risk Assessment and Measurement

Investing involves taking on risks that can impact the return on your investments. Before making any investment decisions, it is crucial to assess and measure the risks involved to make informed choices. This process can help you understand the potential downside and take steps to mitigate risks effectively.

Assessing Risks Before Making Investment Decisions

When assessing risks before investing, it is essential to consider various factors such as market conditions, economic indicators, company performance, and geopolitical events. Conducting a thorough analysis of these factors can help you identify potential risks and their impact on your investments. Additionally, assessing your risk tolerance and investment goals can help you make decisions aligned with your financial objectives.

Common Risk Measurement Techniques

- Standard Deviation: This statistical measure helps investors understand the volatility of an investment by analyzing the dispersion of returns around the average.

- Beta Coefficient: Beta measures the sensitivity of an investment’s returns to market movements, indicating how volatile an investment is compared to the market.

- Value at Risk (VaR): VaR estimates the maximum potential loss an investment portfolio may face over a specific time horizon at a given confidence level.

Risk Assessment Tools for Managing Risks

- Risk Assessment Matrix: This tool helps evaluate the likelihood and impact of various risks, allowing investors to prioritize and address high-impact risks first.

- Scenario Analysis: By simulating different scenarios, investors can assess the potential outcomes of their investments under various conditions, helping them prepare for unforeseen events.

- Sensitivity Analysis: This technique involves changing one variable at a time to understand how it affects the overall investment, providing insights into the sensitivity of the investment to specific factors.

Diversification as a Risk Management Strategy

Diversification is a key strategy in managing investment risks by spreading investments across different asset classes to reduce overall risk exposure. By diversifying, investors aim to minimize the impact of any one investment underperforming or failing.

Role of Diversification in Risk Management

Diversification involves investing in a mix of assets such as stocks, bonds, real estate, and commodities, each with varying levels of risk and return potential. This strategy helps to offset losses in one asset class with gains in another, thereby reducing the overall risk of the investment portfolio.

- Diversification helps to lower the correlation between assets, meaning they do not all move in the same direction at the same time. This can protect the portfolio from significant losses during market downturns.

- By spreading investments across different sectors or industries, diversification can mitigate the impact of sector-specific risks. For example, a downturn in the technology sector may be offset by gains in the healthcare sector.

- Investors can also diversify geographically by investing in assets from different regions or countries. This can help reduce the impact of country-specific risks such as political instability or economic downturns.

Examples of Successful Risk Management through Diversification

One famous example of successful diversification is the investment strategy of renowned investor Warren Buffett. Buffett’s portfolio includes a mix of stocks from various industries such as technology, finance, and consumer goods, along with investments in companies of different sizes.

Another example is the Harvard Endowment Fund, which diversifies its investments across a range of asset classes including equities, fixed income, real estate, and alternative investments. This diversified approach has helped the fund weather market fluctuations and generate stable returns over the long term.

Importance of Setting Investment Objectives

Setting clear investment objectives is crucial in risk management as it provides a roadmap for your investment decisions. By defining your goals, you can align your investments with your risk tolerance and time horizon, helping you make more informed choices.

Significance of Setting Clear Investment Objectives

- Establishing clear objectives helps in determining the level of risk you are willing to take on. This clarity can guide you in selecting investments that match your risk profile.

- Having defined goals also allows you to track your progress and make adjustments as needed. It provides a benchmark to evaluate the success of your investments.

- Setting investment objectives fosters discipline and helps you avoid making impulsive decisions. It keeps you focused on your long-term financial goals.

Aligning Investments with Objectives for Effective Risk Management

- Aligning your investments with your objectives ensures that your portfolio is diversified appropriately. This diversification can help mitigate risks associated with individual assets.

- By connecting your investments with your goals, you can prioritize your financial needs and allocate resources accordingly. This strategic approach can enhance your risk management capabilities.

- Regularly reviewing your investments in relation to your objectives allows you to make informed adjustments based on changing market conditions. It enables you to stay on track towards achieving your financial targets.

Tips for Establishing Realistic and Achievable Investment Goals

- Define specific and measurable objectives that are aligned with your financial aspirations. Avoid setting vague or overly ambitious goals that may lead to disappointment.

- Consider your risk tolerance and investment time horizon when setting goals. Ensure that your objectives are attainable within your comfort level and desired timeframe.

- Seek professional advice or conduct thorough research to set realistic expectations for your investments. Understanding the potential risks and rewards can help you establish achievable goals.

Monitoring and Adjusting Risk Management Strategies

Regularly monitoring investment risks is crucial to ensure that your portfolio aligns with your risk tolerance and financial goals. By keeping a close eye on the performance of your investments, you can identify any deviations from your intended risk exposure and take proactive measures to address them.

Identifying Warning Signs and Triggers

- Monitoring market trends and economic indicators to anticipate potential changes in risk levels.

- Tracking the performance of individual assets or sectors to detect signs of underperformance or excessive volatility.

- Reviewing your portfolio regularly to assess whether it still matches your risk appetite and investment objectives.

Adjusting Risk Management Strategies

- Rebalancing your portfolio by selling overperforming assets and buying underperforming ones to maintain your desired risk exposure.

- Implementing hedging strategies such as options or futures contracts to mitigate specific risks in your portfolio.

- Increasing diversification by adding new asset classes or sectors to spread risk more effectively.

Role of Technology in Investment Risk Management

Technology has revolutionized the way investment risk management is conducted, providing tools and platforms that enhance decision-making processes and optimize risk assessment strategies. The integration of artificial intelligence and data analytics has significantly impacted the landscape of investment risk management, allowing for more accurate predictions and proactive risk management.

Impact of Technology on Investment Risk Management

- Technology has enabled real-time monitoring of investment portfolios, allowing for quick reactions to market changes and potential risks.

- Artificial intelligence algorithms can analyze vast amounts of data to identify patterns and trends, helping investors make informed decisions.

- Data analytics tools provide insights into market behavior and potential risk factors, aiding in the development of risk management strategies.

Use of Artificial Intelligence and Data Analytics

- Artificial intelligence algorithms can predict market movements and identify potential risks before they materialize, allowing for proactive risk management.

- Data analytics tools can assess historical data and market trends to forecast potential risks and optimize investment strategies.

- Machine learning models can continuously learn from new data inputs to improve risk management processes and enhance decision-making capabilities.

Technological Tools for Investment Risk Assessment

- Risk management software platforms offer comprehensive risk assessment features, allowing investors to identify, quantify, and mitigate potential risks.

- Data visualization tools help investors interpret complex data sets and identify key risk factors affecting their investment portfolios.

- Robo-advisors leverage artificial intelligence algorithms to provide personalized investment recommendations based on risk tolerance and financial goals.