Ready to embark on the journey towards financial freedom? Buckle up as we dive into the essential steps that will pave the way to your financial independence. From setting clear goals to exploring investment options, this guide has got you covered. So, let’s roll up our sleeves and start building a solid financial future!

Understanding Financial Freedom

Financial freedom to me personally means having the ability to make choices about how to spend and save my money without feeling restricted by financial constraints. It’s about feeling secure in my financial situation and having the freedom to pursue my goals and dreams without worrying about money.

Setting clear financial goals is crucial in achieving financial freedom. By having specific, measurable goals, I can create a roadmap to follow and track my progress towards financial independence. Whether it’s saving for a big purchase, investing for retirement, or paying off debt, setting clear goals helps me stay focused and motivated.

Financial freedom and financial independence go hand in hand. Financial freedom is the ability to make choices without being limited by financial constraints, while financial independence is the state of having enough wealth to cover all expenses without needing to work actively for income. Achieving financial independence is often seen as the ultimate goal of attaining financial freedom, as it provides a sense of security and peace of mind knowing that one’s financial needs are taken care of.

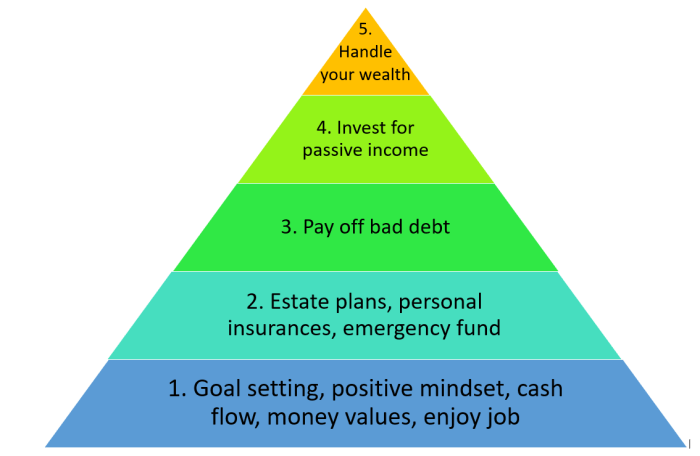

Building a Solid Financial Foundation

Creating a strong financial foundation is crucial for long-term financial success. This involves managing your money effectively, reducing debt, and having a safety net for unexpected expenses.

The Significance of Creating a Budget

- A budget helps you track your income and expenses, allowing you to see where your money is going.

- It enables you to prioritize your spending, save for goals, and avoid overspending.

- By having a budget, you can plan for the future, reduce financial stress, and make informed financial decisions.

Tips on How to Reduce Debt Effectively

- Start by listing all your debts and their interest rates to prioritize which ones to pay off first.

- Consider consolidating high-interest debts into a lower interest loan to reduce overall interest costs.

- Make extra payments whenever possible to accelerate debt repayment and save on interest charges.

- Avoid accumulating new debt while paying off existing ones to prevent further financial strain.

The Importance of Having an Emergency Fund

- An emergency fund provides a financial cushion for unexpected expenses like medical bills, car repairs, or job loss.

- Having an emergency fund prevents you from going into debt to cover unforeseen costs, protecting your financial stability.

- Experts recommend saving 3 to 6 months’ worth of living expenses in your emergency fund for adequate protection.

- By having an emergency fund, you can handle emergencies without derailing your long-term financial goals.

Investing for the Future

Investing for the future is a crucial step towards achieving financial freedom. By making smart investment choices, you can grow your wealth and secure your financial future.

Different Investment Options Available

When it comes to investing, there are various options to consider. Some common investment vehicles include:

- Stocks: Investing in individual companies through the stock market.

- Bonds: Loaning money to governments or corporations in exchange for interest payments.

- Mutual Funds: Pooling money with other investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Real Estate: Investing in properties to generate rental income or capital appreciation.

Compound Interest and Wealth Building

Compound interest plays a significant role in building wealth over time. As your investments earn interest, those earnings are reinvested, allowing your money to grow exponentially. Albert Einstein once called compound interest “the eighth wonder of the world.” Remember, the key is to start investing early to take full advantage of the power of compound interest.

Strategies for Diversifying Your Investment Portfolio

Diversification is essential to reduce risk and maximize returns. Here are some strategies to diversify your investment portfolio:

- Asset Allocation: Spread your investments across different asset classes, such as stocks, bonds, and real estate.

- Rebalancing: Regularly review and adjust your portfolio to maintain your desired asset allocation.

- International Diversification: Invest in global markets to reduce exposure to country-specific risks.

- Alternative Investments: Consider adding alternative assets like commodities or cryptocurrencies to your portfolio for further diversification.

Generating Passive Income

Generating passive income is a key step towards financial freedom. It involves earning money with minimal effort on an ongoing basis. There are various sources of passive income that you can explore to diversify your income streams and build wealth over time.

Rental Properties

Investing in rental properties is a popular way to generate passive income. By owning and renting out real estate, you can earn rental income regularly. It’s essential to research the market, location, and potential return on investment before purchasing a rental property.

Dividend Stocks

Investing in dividend stocks allows you to earn passive income through regular dividend payments from companies. It’s crucial to choose stable and reputable companies with a history of paying dividends consistently. Diversifying your dividend stock portfolio can help reduce risk.

Online Businesses

Starting an online business, such as creating and selling digital products, affiliate marketing, or blogging, can generate passive income. Building a successful online business takes time and effort initially but can lead to a steady income stream once established.

Tips for Starting Passive Income Streams

– Research different passive income opportunities and choose the ones that align with your interests and financial goals.

– Start small and gradually scale your passive income streams over time.

– Stay informed about market trends and changes to optimize your passive income sources.

– Consider seeking advice from financial advisors or experienced investors to make informed decisions.

Benefits of Multiple Streams of Passive Income

Having multiple streams of passive income provides financial stability and resilience against economic downturns or unexpected expenses. Diversifying your passive income sources can also enhance your overall income potential and reduce dependency on a single source of income.

Planning for Retirement

Retirement planning is a crucial aspect of achieving financial freedom. It involves setting aside funds and investments to support your lifestyle once you stop working. By planning for retirement early, you can ensure a comfortable and secure future for yourself.

The Importance of Retirement Planning

Retirement planning is essential because it allows you to maintain your standard of living after you retire. Without proper planning, you may struggle to cover your expenses and medical costs during retirement. It also helps you avoid relying solely on Social Security benefits, which may not be sufficient to meet all your needs.

- Start saving as early as possible to take advantage of compound interest.

- Consider using retirement accounts like 401(k) or IRA for tax advantages.

- Regularly review and adjust your retirement plan to accommodate changes in your financial situation.

- Consult with a financial advisor to create a personalized retirement strategy.

Early Retirement Planning Impact

Starting retirement planning early can significantly impact your financial freedom. By saving and investing consistently over time, you can build a substantial retirement nest egg that provides financial security and flexibility. Early planning also allows you to weather market fluctuations and unexpected expenses more effectively.

Remember, it’s never too early to start planning for retirement. The sooner you begin, the more time your money has to grow and work for you.

Mindset and Habits for Financial Success

Having the right mindset and developing good habits are crucial aspects of achieving financial success. Your attitude towards money and your daily practices can greatly impact your journey towards financial freedom.

The Role of Mindset in Achieving Financial Freedom

Your mindset determines your success.

Having a positive and proactive mindset is essential when it comes to achieving financial freedom. Believing in your ability to reach your goals, staying focused, and being resilient in the face of challenges are key components of a successful financial mindset. By cultivating a mindset of abundance and growth, you can attract opportunities and take the necessary actions to secure your financial future.

Habits for Financial Success

- Setting clear financial goals: Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your financial journey.

- Creating and sticking to a budget: Track your income and expenses, prioritize spending, and save and invest consistently.

- Avoiding debt and managing credit wisely: Minimize high-interest debt, pay off outstanding balances, and use credit responsibly to build a strong financial foundation.

- Investing in yourself: Continuously learn about personal finance, explore new opportunities, and develop skills that can increase your earning potential.

- Seeking guidance and mentorship: Surround yourself with positive influences, seek advice from financial experts, and learn from the experiences of successful individuals in the field.

Importance of Continuous Financial Education

Knowledge is power.

Educating yourself about personal finance is key to making informed decisions, managing risks, and maximizing opportunities for growth. Stay updated on financial trends, explore different investment options, and be open to learning from both successes and failures. By expanding your financial knowledge and skills, you can adapt to changing circumstances, make strategic choices, and secure a stable financial future.