With retirement savings plans at the forefront, get ready to dive into a world where financial freedom meets strategic planning. From 401(k)s to Roth IRAs, this journey will uncover the secrets to securing a comfortable retirement.

Let’s break down the different types of retirement savings plans and unravel the complexities of contribution limits, employer-sponsored plans, and withdrawal rules. Get ready to take charge of your financial future like a boss!

Types of Retirement Savings Plans

When it comes to preparing for retirement, there are several types of savings plans to consider. Each plan has its own features and eligibility criteria, so it’s important to understand the differences before deciding which one is right for you.

401(k) Plan

A 401(k) plan is a retirement savings account sponsored by an employer. Employees can contribute a portion of their salary to the plan, and some employers may also match a percentage of the contributions. One key feature of a 401(k) plan is that contributions are made on a pre-tax basis, which can lower your taxable income.

Individual Retirement Account (IRA)

An Individual Retirement Account, or IRA, is a retirement savings account that an individual can open independently of their employer. There are different types of IRAs, including traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deferred growth on contributions, while Roth IRAs allow for tax-free withdrawals in retirement.

Pension Plans

Pension plans are retirement plans that are typically funded by an employer. These plans provide a fixed monthly payment to retirees based on factors such as salary history and years of service. Unlike 401(k) plans or IRAs, pension plans do not require employee contributions and are managed by the employer.

Importance of Retirement Savings

Starting a retirement savings plan early is crucial for securing a comfortable future. By beginning to save for retirement at a young age, individuals can take advantage of compound interest and have more time for their money to grow.

Impact of Inflation on Retirement Savings

Inflation can erode the purchasing power of retirement savings over time. As prices of goods and services increase, the value of money decreases. To mitigate the impact of inflation on retirement savings, it is important to invest in assets that have the potential to outpace inflation, such as stocks or real estate.

Compound Interest Benefits

Compound interest is a powerful tool that can significantly boost retirement savings over time. By reinvesting the returns earned on investments, individuals can earn interest on their interest, leading to exponential growth. For example, an individual who starts saving for retirement in their 20s can potentially accumulate a much larger nest egg compared to someone who starts later, due to the compounding effects of interest.

Contribution Limits and Strategies

When it comes to retirement savings plans, it is crucial to understand the contribution limits set for each plan and how you can maximize your contributions to secure a comfortable retirement. Additionally, individuals nearing retirement age should also consider catch-up contributions to boost their savings. Let’s dive into the details.

Contribution Limits for Various Retirement Savings Plans

- 401(k) Plans: In 2021, the contribution limit for 401(k) plans is $19,500 for individuals under 50 years old. For those 50 and older, an additional catch-up contribution of $6,500 is allowed, bringing the total limit to $26,000.

- IRA (Traditional and Roth): For both Traditional and Roth IRAs, the contribution limit for 2021 is $6,000 for individuals under 50. Those 50 and older can make an additional catch-up contribution of $1,000, making the total limit $7,000.

- 403(b) and 457 Plans: The contribution limits for 403(b) and 457 plans are the same as 401(k) plans. Individuals under 50 can contribute up to $19,500, with a catch-up contribution limit of $6,500 for those 50 and older.

Strategies for Maximizing Contributions to Retirement Savings Plans

- Start Early: The power of compounding interest works best when you start saving early. Make consistent contributions to your retirement accounts to take full advantage of this benefit.

- Automate Contributions: Set up automatic contributions from your paycheck to your retirement accounts. This ensures that you are consistently saving without having to think about it.

- Take Advantage of Employer Match: If your employer offers a matching contribution to your retirement plan, make sure to contribute enough to maximize this benefit. It’s essentially free money for your retirement savings.

Catch-up Contributions for Individuals Nearing Retirement Age

- If you are 50 or older and behind on your retirement savings, catch-up contributions allow you to contribute additional funds to your retirement accounts. This can help boost your savings and make up for lost time as you approach retirement.

- Consider your financial situation and consult with a financial advisor to determine the optimal amount for catch-up contributions based on your retirement goals and timeline.

Employer-Sponsored Retirement Plans

When it comes to saving for retirement, employer-sponsored retirement plans play a crucial role in helping individuals secure their financial future. These plans, such as 401(k) and pension plans, offer unique features and benefits that can significantly impact one’s retirement savings journey.

401(k) and Pension Plans

Employer-sponsored retirement plans like 401(k) and pension plans are designed to help employees save for retirement by allowing them to contribute a portion of their salary to a tax-advantaged account. These plans often come with employer matching contributions, which can boost the overall savings potential for employees.

- Employer Matching Contributions: One of the key features of employer-sponsored retirement plans is the employer matching contributions. This means that employers will match a certain percentage of the employee’s contributions, up to a certain limit. This matching contribution is essentially free money added to the employee’s retirement savings, helping them grow their nest egg faster.

- Rollover Options: When changing jobs, employees have the option to rollover their employer-sponsored retirement plan funds into a new plan or an individual retirement account (IRA). This allows individuals to maintain the tax-advantaged status of their retirement savings and continue building their nest egg without facing immediate tax consequences.

Withdrawal Rules and Penalties

When it comes to retirement savings plans, understanding the withdrawal rules and penalties is crucial for making informed decisions about your financial future.

Early withdrawals from retirement accounts can result in significant penalties and tax consequences. Most retirement plans impose a penalty for withdrawing funds before a certain age, typically 59 and a half. This penalty is usually around 10% of the amount withdrawn, on top of any applicable income taxes.

401(k) and IRA Withdrawal Rules

- For traditional 401(k) and IRA accounts, withdrawals made before the age of 59 and a half may incur a 10% early withdrawal penalty.

- Roth IRA contributions can be withdrawn penalty-free, but earnings on those contributions may be subject to penalties if withdrawn early.

- 401(k) loans are an option for some plans and allow you to borrow from your retirement savings without incurring early withdrawal penalties.

Best Practices for Withdrawing Funds During Retirement

- Consider delaying Social Security benefits to maximize your monthly payments during retirement.

- Create a withdrawal strategy that balances your income needs with tax implications to minimize penalties.

- Consult with a financial advisor to discuss the best withdrawal options based on your specific financial situation and retirement goals.

Retirement Planning Tools and Resources

When it comes to planning for retirement, there are various tools and resources available to help individuals make informed decisions and secure their financial future.

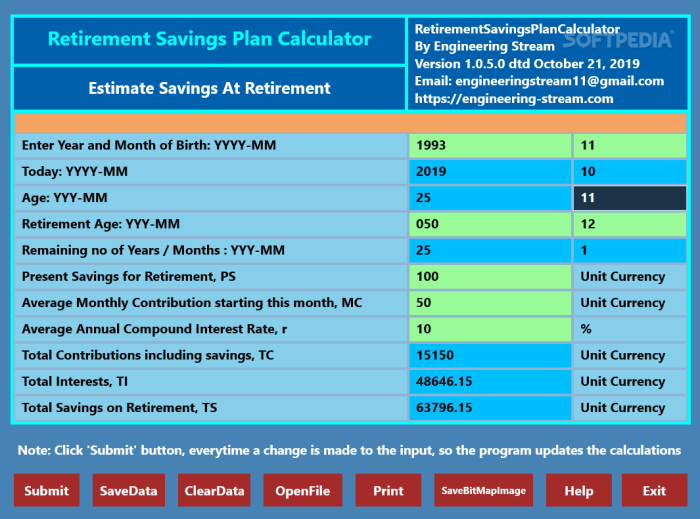

Online Retirement Planning Tools and Calculators

Online retirement planning tools and calculators are valuable resources that can assist individuals in estimating their retirement needs, determining how much they need to save each month, and projecting their retirement income. Some popular tools include:

- Retirement savings calculators: These tools help individuals calculate how much they need to save each month to reach their retirement goals.

- Social Security calculators: These tools estimate Social Security benefits based on individual earnings history and retirement age.

- Investment calculators: These tools help individuals forecast investment growth and assess the impact of different investment strategies on retirement savings.

Role of Financial Advisors

Financial advisors play a crucial role in creating retirement savings plans by providing personalized guidance, investment advice, and helping individuals navigate complex financial decisions. They can assist in developing a comprehensive retirement strategy, optimizing investment portfolios, and adjusting plans as needed to achieve long-term financial goals.

Resources for Staying Informed

Staying informed about changes in retirement savings laws and regulations is essential for effective retirement planning. Resources to help individuals stay up-to-date include:

- Government websites: Websites like the IRS and Social Security Administration provide information on retirement savings laws, contribution limits, and tax implications.

- Financial news outlets: Following financial news outlets and publications can help individuals stay informed about changes in retirement planning rules and regulations.

- Professional organizations: Membership in professional organizations like the Financial Planning Association can provide access to resources, updates, and networking opportunities related to retirement planning.