Diving into the world of passive income ideas, this introduction sets the stage for an eye-opening exploration filled with potential opportunities for financial growth. From real estate investments to online business ventures, discover the secrets to generating income while you sleep.

Get ready to uncover the hidden gems of passive income streams and learn how to turn your assets into sources of continuous revenue.

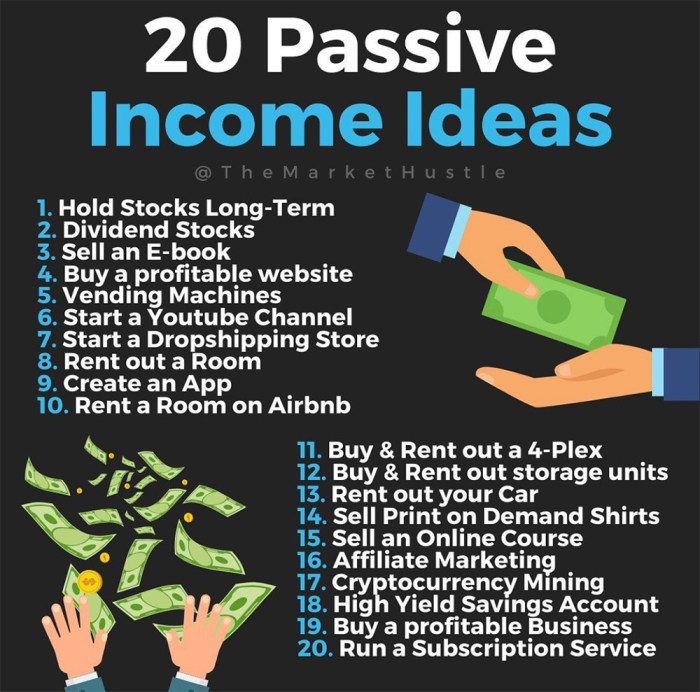

Passive Income Ideas

Passive income is money earned with little to no effort on the part of the recipient. It’s a way to generate income without actively working for it, allowing individuals to make money while they sleep. Here are five different passive income streams to consider:

1. Rental Properties

Investing in rental properties can be a lucrative passive income stream. By purchasing real estate and renting it out to tenants, you can earn a steady stream of income each month.

2. Dividend Stocks

Dividend stocks are shares of companies that pay out a portion of their profits to shareholders. By investing in dividend stocks, you can earn passive income through regular dividend payments.

3. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral. This can be done through blog posts, social media, or other online platforms.

4. Create and Sell Digital Products

Creating and selling digital products like e-books, online courses, or stock photography can be a great way to earn passive income. Once the initial product is created, you can continue to sell it without much additional effort.

5. Peer-to-Peer Lending

Peer-to-peer lending platforms allow you to lend money to individuals or businesses in exchange for interest payments. This can be a passive way to earn income through interest payments over time.

Successful passive income ventures include websites that generate ad revenue, YouTube channels with a large following, and automated online businesses. By diversifying your passive income streams, you can build a more stable financial future and achieve greater financial freedom.

Real Estate Investments

Investing in real estate can be a lucrative way to generate passive income. By leveraging the power of property ownership, individuals can earn money without actively working for it. There are several strategies that one can employ to make passive income through real estate.

Rental Properties

Rental properties are a popular option for generating passive income in real estate. By purchasing a property and renting it out to tenants, investors can earn a steady stream of income each month. This income can cover the mortgage, property taxes, and other expenses, while still providing a profit.

Real Estate Crowdfunding

Real estate crowdfunding is a newer method of investing in real estate that allows individuals to pool their resources together to invest in larger properties. This can be a more accessible way for smaller investors to get involved in real estate without having to buy a property outright. Investors can earn passive income through rental returns or property appreciation.

REITs

Real Estate Investment Trusts (REITs) are another option for passive income in real estate. REITs are companies that own and manage a portfolio of income-producing properties. By investing in REITs, individuals can earn passive income through dividends without having to directly own or manage any properties themselves. This can be a more hands-off approach to real estate investing.

Online Business

Creating passive income through online businesses is a popular and lucrative option for those looking to generate extra money without actively working for it. Whether through affiliate marketing, dropshipping, or selling digital products, there are multiple ways to build a successful online passive income stream.

Affiliate Marketing

Affiliate marketing involves promoting products or services from other companies and earning a commission for each sale made through your referral. Here are some tips for building a successful affiliate marketing business:

- Choose a niche that aligns with your interests and expertise.

- Build a strong online presence through a website, blog, or social media channels.

- Focus on providing valuable content to your audience to build trust and credibility.

- Select reputable affiliate programs with products or services that resonate with your audience.

- Track and analyze your performance to optimize your strategies and maximize earnings.

Dropshipping

Dropshipping is a business model where you sell products to customers without holding any inventory. The supplier ships the products directly to the customer, and you earn a profit from the price difference. Here are some tips for a successful dropshipping business:

- Research and select reliable suppliers with quality products and fast shipping times.

- Create a user-friendly e-commerce website to showcase your products and attract customers.

- Implement effective marketing strategies to drive traffic to your online store and increase sales.

- Provide excellent customer service to build a loyal customer base and generate repeat business.

- Stay updated on market trends and adjust your product offerings accordingly to stay competitive.

Selling Digital Products

Selling digital products such as e-books, online courses, software, or digital art can be a profitable passive income stream. Here are some tips for success in selling digital products online:

- Create high-quality digital products that provide value and solve a problem for your target audience.

- Utilize online platforms like Etsy, Amazon, or your own website to sell your digital products.

- Market your digital products through social media, email marketing, and collaborations with influencers in your niche.

- Offer excellent customer support to address any issues or questions from your customers promptly.

- Regularly update and improve your digital products based on feedback and market demand to increase sales and customer satisfaction.

Investment Opportunities

Investing in stocks, bonds, or index funds can be a smart move to generate passive income. By purchasing shares of profitable companies or government or corporate bonds, you can earn dividends or interest payments regularly without having to actively work for it.

Dividend Investing

- Dividend investing involves buying stocks that pay out dividends regularly to shareholders.

- Companies that have a history of paying consistent dividends are often seen as stable and reliable investments.

- Reinvesting dividends can help compound your returns over time, leading to significant passive income growth.

Comparing Investment Opportunities

| Investment Type | Pros | Cons |

|---|---|---|

| Stocks | High potential for growth | Risk of volatility and potential losses |

| Bonds | Steady income stream | Lower returns compared to stocks |

| Index Funds | Diversification and lower risk | Limited control over individual investments |