Get ready to level up your financial game with these personal finance tips that are essential for building a stable and secure future. From budgeting strategies to debt management, this guide will equip you with the knowledge needed to take control of your financial well-being.

Importance of Personal Finance Management

Managing personal finances is like having a secret weapon in your back pocket, ready to tackle any financial challenge that comes your way. It’s all about taking control of your money instead of letting it control you.

When you have a solid grasp on your finances, you set yourself up for financial stability in the long run. You can weather unexpected expenses, save for your future goals, and even invest in opportunities that come your way. It’s like building a strong financial foundation that can support you through thick and thin.

Long-Term Benefits of Effective Personal Finance Management

- Building a healthy savings cushion for emergencies and future goals.

- Reducing financial stress and anxiety by knowing where your money is going.

- Creating opportunities for investments and wealth-building.

- Setting yourself up for a comfortable retirement down the road.

Good Financial Habits Leading to Financial Freedom

- Consistently tracking your expenses and income to understand your financial health.

- Setting realistic budgets and sticking to them to avoid overspending.

- Automating savings and investments to build wealth over time.

- Regularly reviewing and adjusting your financial goals to stay on track.

Budgeting Strategies

Budgeting is a crucial aspect of personal finance management that helps individuals take control of their finances, set financial goals, and ultimately achieve financial stability. Here are some effective budgeting strategies to consider:

Creating a Realistic Budget

Creating a realistic budget involves accurately assessing your income, expenses, and financial goals. Follow these steps to create a budget that works for you:

- List all your sources of income, including salary, bonuses, and any additional income.

- Track your expenses for a month to understand your spending habits.

- Categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out).

- Set realistic financial goals, such as saving for emergencies, retirement, or a big purchase.

- Allocate a portion of your income to each expense category, ensuring you have some left for savings.

Comparison of Budgeting Methods

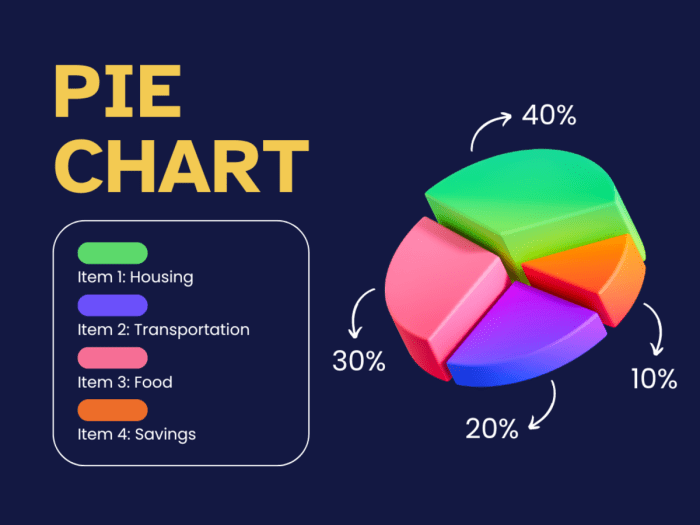

There are various budgeting methods available, each with its own approach to managing finances. Two popular methods are zero-based budgeting and the 50/30/20 rule:

Zero-based budgeting requires you to allocate every dollar of your income to a specific expense or savings category, leaving no room for unassigned funds.

The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

Tracking Expenses and Adjusting Budgets

Tracking your expenses is essential to ensure that you are sticking to your budget and meeting your financial goals. Use budgeting apps or spreadsheets to track your expenses regularly and adjust your budget as needed:

- Review your expenses weekly or monthly to see where you may be overspending.

- Adjust your budget categories based on changes in income, expenses, or financial goals.

- Be flexible and willing to make changes to your budget to accommodate unexpected expenses or changes in your financial situation.

Saving and Investing Tips

Building a solid financial foundation involves not only managing your budget effectively but also saving and investing wisely. Here are some tips to help you make the most of your money:

Importance of Emergency Funds and How to Build One

Having an emergency fund is crucial for unexpected expenses like medical emergencies, car repairs, or sudden job loss. Follow these steps to build your emergency fund:

- Set a realistic goal: Aim to save 3 to 6 months’ worth of living expenses.

- Automate your savings: Set up automatic transfers to a high-yield savings account every month.

- Cut unnecessary expenses: Identify areas where you can reduce spending to boost your savings.

- Keep your emergency fund separate: Avoid dipping into it for non-emergencies.

Different Investment Options for Beginners

For beginners looking to start investing, here are some options to consider:

- Savings accounts: Offer low risk and easy access to funds, but with lower returns.

- Stock market: Buying shares of companies can offer higher returns but comes with more risk.

- Exchange-Traded Funds (ETFs): Provide diversification and lower fees for beginners.

- Robo-advisors: Automated investment platforms that create diversified portfolios based on your risk tolerance.

Tips on How to Diversify Investment Portfolios for Risk Management

Diversifying your investment portfolio can help reduce risk. Here are some tips to achieve diversification:

- Invest in different asset classes: Spread your investments across stocks, bonds, real estate, and other assets.

- Consider international investments: Look beyond your home country for opportunities in global markets.

- Rebalance your portfolio regularly: Adjust your asset allocation to maintain desired risk levels.

- Use dollar-cost averaging: Invest a fixed amount regularly to reduce the impact of market volatility.

Debt Management

When it comes to managing debt, it’s crucial to have a clear strategy in place to pay off your debts effectively. Debt can have a significant impact on your personal finances and credit score, so prioritizing high-interest debt is key to financial stability.

Strategies for Paying Off Debt Effectively

- Create a budget: Knowing how much money you have coming in and going out is essential for developing a plan to pay off your debts.

- Snowball method: Start by paying off your smallest debt first, then move on to the next one. This method can provide a sense of accomplishment and motivation to continue tackling your debts.

- Avalanche method: Focus on paying off the debt with the highest interest rate first, then move on to the next highest. This can save you money on interest in the long run.

Impact of Debt on Personal Finances and Credit Score

- High levels of debt can lead to financial stress and make it difficult to achieve your financial goals.

- Carrying high-interest debt can result in paying more money in interest over time, which can hinder your ability to save and invest for the future.

- Your credit score can be negatively affected by high levels of debt, making it harder to qualify for loans or credit cards with favorable terms.

Financial Goal Setting

Setting financial goals is crucial for achieving long-term financial success. By establishing clear objectives, you can create a roadmap to follow and stay motivated along the way.

Guide on Setting Realistic Financial Goals

- Start by identifying your priorities and values. What do you want to achieve financially?

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to ensure clarity and focus.

- Consider both short-term and long-term goals to maintain a balance between immediate needs and future aspirations.

Breaking Down Long-Term Goals into Actionable Steps

- Break down your long-term goals into smaller, manageable milestones to track your progress effectively.

- Create a timeline with deadlines for each milestone to keep yourself accountable and on track.

- Celebrate small victories along the way to stay motivated and encouraged to continue working towards your goals.

Revisiting and Adjusting Financial Goals Periodically

- Regularly review your financial goals to assess your progress and make any necessary adjustments based on changing circumstances.

- Consider factors like income changes, unexpected expenses, or shifting priorities that may impact your original goals.

- Be flexible and willing to adapt your goals as needed to ensure they remain relevant and achievable in the long run.