Yo, diving into the world of Planning for healthcare costs in retirement, this intro sets the stage for a rad journey through the ins and outs of healthcare expenses post-retirement. Get ready to level up your financial planning game!

In the following paragraph, we’ll break down the nitty-gritty details of why planning for healthcare costs in retirement is absolutely crucial.

Importance of Planning for Healthcare Costs in Retirement

Planning for healthcare costs in retirement is crucial for ensuring financial stability and peace of mind during your golden years. As retirees age, the need for medical care and prescription drugs typically increases, leading to higher healthcare expenses. Failing to plan adequately for these costs can have a significant impact on retirement savings, potentially jeopardizing the quality of life and overall financial well-being of retirees.

Key Reasons Why Healthcare Costs are a Significant Consideration for Retirees

- Rising Healthcare Costs: Healthcare expenses tend to rise as individuals age, with costs for services, medications, and long-term care often outpacing inflation rates.

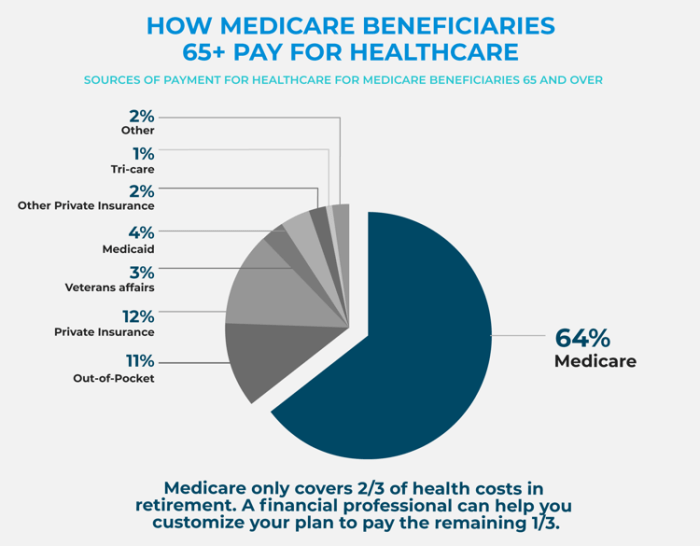

- Medicare Limitations: While Medicare provides coverage for many healthcare services, it does not cover all expenses, such as dental care, vision care, and long-term care. Retirees may need to pay out-of-pocket for these services.

- Healthcare Inflation: Healthcare inflation typically outpaces general inflation rates, putting pressure on retirees’ budgets and savings.

- Unforeseen Medical Emergencies: Unexpected health issues or emergencies can arise, leading to substantial healthcare costs that retirees may not have planned for.

How Inadequate Planning for Healthcare Costs Can Impact Retirement Savings

- Depletion of Savings: Without proper planning, retirees may have to dip into their retirement savings to cover healthcare expenses, leading to a depletion of funds that were intended for other purposes.

- Financial Stress: The burden of unanticipated healthcare costs can cause significant financial stress for retirees, impacting their overall well-being and quality of life in retirement.

- Limited Access to Care: Inadequate planning may result in retirees being unable to afford necessary healthcare services or medications, potentially impacting their health outcomes and quality of life.

Understanding Healthcare Expenses in Retirement

As retirees age, healthcare expenses become a significant part of their financial planning. It is crucial to understand the types of healthcare costs retirees face, how they differ from those during working years, and the unexpected expenses that may arise.

Common Types of Healthcare Expenses

- Medicare premiums and out-of-pocket costs

- Prescription medications

- Doctor visits and specialist care

- Dental and vision care

- Long-term care services

Comparison of Healthcare Costs in Retirement vs. Working Years

In retirement, healthcare costs may increase due to the need for more frequent medical care and specialized services. Retirees often face higher out-of-pocket expenses as well, especially if they rely on Medicare for coverage.

Examples of Unexpected Healthcare Costs

- Emergency room visits

- Sudden illness or injury requiring intensive care

- Home modifications for aging in place

- Coverage gaps in Medicare or supplemental insurance

Strategies for Managing Healthcare Costs in Retirement

In retirement, managing healthcare costs is crucial to ensure financial stability and peace of mind. There are various strategies retirees can utilize to mitigate healthcare expenses and plan for their future needs.

Purchasing Long-Term Care Insurance

Long-term care insurance can be a valuable investment for retirees looking to protect their assets and savings from the potentially high costs of long-term care services. Here are some advantages and disadvantages to consider:

- Advantages:

Long-term care insurance can help cover expenses for services not typically covered by Medicare or other health insurance plans. It provides financial protection and peace of mind for retirees and their families.

- Disadvantages:

Long-term care insurance can be expensive, and premiums may increase over time. Additionally, not everyone may qualify for coverage, especially if pre-existing conditions are present.

Saving on Prescription Drug Costs

Prescription drug costs can quickly add up and become a significant burden for retirees. Here are some tips on how retirees can save on prescription drug expenses:

- Compare prices at different pharmacies to find the best deals on medications.

- Ask your healthcare provider about generic alternatives or prescription assistance programs.

- Consider mail-order pharmacies for lower prices on prescription refills.

- Look into prescription discount cards or programs offered by drug manufacturers.

Incorporating Healthcare Costs into Retirement Planning

When planning for retirement, it’s crucial to consider healthcare costs as a significant part of your budget. These expenses can vary greatly depending on your health status, age, and location, so estimating them accurately is essential to ensure a financially secure retirement.

Estimating Healthcare Costs in Retirement Budget

- Start by reviewing your current healthcare expenses to get an idea of what you’re currently spending.

- Consider factors like inflation and potential increases in medical costs as you age.

- Research typical healthcare costs for retirees in your area and factor in unexpected expenses.

Incorporating Healthcare Costs into Retirement Investment Strategies

- Allocate a portion of your retirement savings specifically for healthcare expenses.

- Explore options like Health Savings Accounts (HSAs) or long-term care insurance to help cover future medical costs.

- Consider investing in assets that can provide steady income to cover healthcare expenses, such as dividend-paying stocks or bonds.

Revisiting and Adjusting Healthcare Cost Estimates Over Time

It’s important to regularly review and adjust your healthcare cost estimates as you move through retirement. Factors like changes in health, medical advances, and shifts in healthcare policies can all impact your expenses. By staying proactive and updating your budget accordingly, you can ensure that you’re adequately prepared for any healthcare costs that may arise in the future.