Diving into the world of managing expenses effectively, this introduction sets the stage for a deep exploration of financial savvy that’s essential for individuals and businesses alike. Get ready to uncover some game-changing strategies in the realm of budgeting, tracking expenses, cost-cutting, and more.

In a world where financial health is key, knowing how to effectively manage expenses can make all the difference.

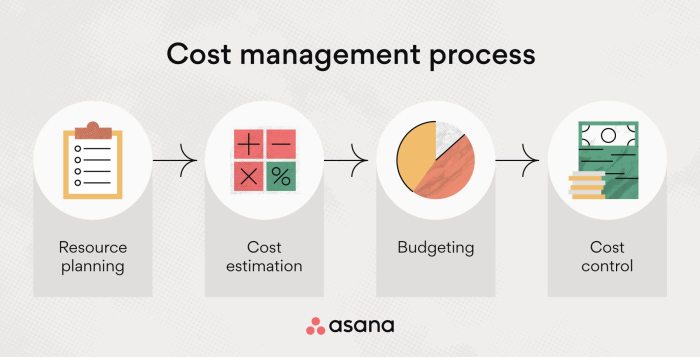

Importance of Managing Expenses Effectively

Effective expense management is crucial for both individuals and businesses to maintain financial stability and achieve long-term success. By carefully monitoring and controlling expenses, individuals can avoid unnecessary debt, build savings, and work towards achieving their financial goals. Similarly, for businesses, managing expenses effectively can lead to increased profitability, improved cash flow, and overall sustainability.

Impact of Poor Expense Management on Financial Health

Poor expense management can have detrimental effects on financial health. For individuals, overspending or neglecting to track expenses can result in accumulating debt, hinder savings growth, and limit opportunities for investments. In contrast, for businesses, uncontrolled expenses can lead to decreased profitability, cash flow problems, and even potential bankruptcy. It is essential to prioritize expense management to ensure financial well-being and avoid financial pitfalls.

Examples of Successful Financial Management Strategies

- Creating a detailed budget: Establishing a budget helps individuals and businesses allocate funds to essential expenses, savings, and investments, ensuring that financial resources are utilized effectively.

- Tracking expenses: Regularly monitoring and analyzing expenses can identify unnecessary costs, allowing for adjustments and optimizations to improve financial efficiency.

- Implementing cost-cutting measures: Finding ways to reduce expenses without compromising quality can lead to significant savings over time, contributing to improved financial health.

- Seeking professional advice: Consulting financial advisors or experts can provide valuable insights and guidance on managing expenses, investments, and overall financial planning.

Budgeting Techniques

Budgeting techniques are essential for effectively managing expenses. By creating a budget and sticking to it, individuals can track their spending, prioritize their financial goals, and avoid unnecessary debt. Let’s explore some common budgeting techniques that can help individuals take control of their finances.

Traditional Budgeting Methods vs. Modern Digital Tools

Traditional budgeting methods typically involve pen and paper or using spreadsheets to track income and expenses. This method requires manual input and calculations, which can be time-consuming and prone to errors. On the other hand, modern digital tools like budgeting apps and software offer automated features that can sync with bank accounts, categorize expenses, and provide real-time updates on spending habits. While traditional methods may work for some individuals who prefer a hands-on approach, digital tools offer convenience and efficiency in managing finances.

Tips for Creating a Realistic and Effective Budget

- Start by tracking your expenses: Before creating a budget, it’s important to understand where your money is going. Keep track of all your expenses for a month to identify patterns and areas where you can cut back.

- Set realistic goals: When creating a budget, set achievable financial goals that align with your income and expenses. Whether it’s saving for a vacation or paying off debt, make sure your goals are attainable.

- Categorize your expenses: Divide your expenses into categories such as housing, utilities, groceries, transportation, and entertainment. This will help you allocate funds accordingly and prioritize essential expenses.

- Monitor and adjust your budget: Regularly review your budget and track your progress. Make adjustments as needed to accommodate unexpected expenses or changes in income.

- Use budgeting tools: Take advantage of budgeting apps and software that can automate calculations, provide insights on spending habits, and send alerts for overspending. These tools can streamline the budgeting process and help you stay on track.

Tracking Expenses

Tracking expenses is a crucial part of managing your finances effectively. By keeping a close eye on where your money is going, you can make informed decisions about your spending habits and identify areas where you can cut back or save more.

Various Tools and Apps for Tracking Expenses

- 1. Mint: A popular app that syncs with your bank accounts and categorizes your transactions automatically.

- 2. YNAB (You Need a Budget): Helps you create a budget and track your expenses in real-time.

- 3. PocketGuard: Analyzes your spending patterns and suggests ways to save money.

Best Practices for Categorizing and Organizing Expense Data

- 1. Create specific categories: Divide your expenses into categories like groceries, rent, utilities, etc., to get a clear picture of where your money is going.

- 2. Regularly review and update: Make it a habit to review your expenses weekly or monthly to ensure accuracy and make adjustments as needed.

- 3. Use tags or labels: Assign tags or labels to your expenses to easily track and analyze your spending habits over time.

Cost-Cutting Strategies

When it comes to managing expenses effectively, one key aspect is finding ways to cut costs without compromising your quality of life. By identifying areas where expenses can be reduced and distinguishing between needs and wants, you can create a more sustainable budget. Let’s explore some creative strategies for cutting costs.

Identify Common Areas for Cost Reduction

- Reduce dining out expenses by cooking at home more often.

- Cancel unused subscriptions or memberships.

- Opt for generic brands instead of name brands for certain products.

- Lower utility bills by being mindful of energy consumption.

Needs vs. Wants in Expense Management

- Focus on covering essential expenses like housing, food, and healthcare first.

- Avoid unnecessary purchases that fall under the category of wants rather than needs.

- Consider the long-term benefits of an expense before deciding if it is a need or a want.

Creative Ways to Cut Costs

- Shop at thrift stores or online marketplaces for clothing and household items.

- Meal prep to reduce food waste and save money on groceries.

- Use public transportation or carpool to save on gas and maintenance costs.

- Look for free or low-cost entertainment options in your community.

Investment Opportunities

Effective expense management can open up doors to various investment opportunities. By carefully tracking and controlling your expenses, you can free up extra funds that can be put towards investments for the future. This not only helps in securing your financial stability but also allows you to grow your wealth over time.

Setting Aside Funds for Future Investments

When managing expenses effectively, it is crucial to allocate a portion of your income towards future investments. By consistently setting aside funds, you can build a solid financial foundation that will support your investment goals. This disciplined approach ensures that you have the necessary resources available when opportunities arise in the market.

- Automate your savings: Set up automatic transfers to a separate investment account to ensure that funds are consistently allocated towards investments.

- Establish clear investment goals: Define your investment objectives and time horizon to guide your decision-making process.

- Consult with a financial advisor: Seek professional advice to help you create a customized investment plan tailored to your financial situation.

Researching and Evaluating Potential Investment Options

Before diving into any investment opportunity, it is essential to conduct thorough research and evaluation. This includes assessing the potential risks and returns associated with the investment to make informed decisions.

- Study the market trends: Stay informed about the latest market developments and trends to identify promising investment opportunities.

- Diversify your portfolio: Spread your investments across different asset classes to minimize risk and maximize returns.

- Monitor your investments: Regularly review the performance of your investments and make adjustments as needed to align with your financial goals.

Emergency Fund Planning

Having an emergency fund is crucial for managing unexpected expenses that may arise. It serves as a safety net to cover unforeseen costs without derailing your financial stability.

Creating and Maintaining an Emergency Fund

One way to create an emergency fund is by setting aside a portion of your income each month specifically for this purpose. Start by determining how much you need to cover at least three to six months’ worth of living expenses.

- Automate your savings by setting up a direct deposit or recurring transfer to your emergency fund account.

- Consider opening a high-yield savings account or a money market account to earn some interest on your emergency fund.

- Revisit and adjust your emergency fund target amount regularly based on changes in your expenses or income.

Examples of Emergency Fund Lifesavers

An emergency fund can be a financial lifesaver in situations such as:

- Unexpected medical expenses, like a sudden illness or injury that requires costly treatment.

- Car repairs or home maintenance issues that are essential but not budgeted for.

- Job loss or sudden reduction in income, providing a buffer as you look for new employment opportunities.