Ready to dive into the world of building wealth? Strap in as we explore the ins and outs of financial success, from setting goals to managing debt like a boss. Get ready to level up your money game with this comprehensive guide.

Let’s break down the key steps to building wealth and securing your financial future.

Importance of Building Wealth

Building wealth is crucial for achieving financial security in the long run. It provides a safety net for unexpected expenses, retirement planning, and overall peace of mind. By accumulating wealth, individuals can have more control over their financial future and be better prepared for any financial challenges that may arise.

Opportunities for Future Generations

Building wealth can create opportunities for future generations by setting up a solid financial foundation. For example, parents who have accumulated wealth can pass down assets or investments to their children, giving them a head start in life. This can lead to better access to education, improved living conditions, and overall financial stability for the next generation.

Financial Independence

Wealth-building can lead to greater financial independence by reducing reliance on paycheck-to-paycheck living. With a solid financial base, individuals can pursue their passions, take calculated risks, and have the freedom to make choices that align with their long-term goals. Achieving financial independence through wealth accumulation can provide a sense of fulfillment and empowerment.

Setting Financial Goals

Setting specific financial goals is crucial when it comes to building wealth. It provides a clear direction and purpose for your financial actions, helping you stay focused and motivated along the way. Without clear goals, it’s easy to lose track of your progress and make decisions that may not align with your long-term objectives.

Short-term vs. Long-term Financial Goals

- Short-term financial goals typically cover a period of one year or less. These goals are more immediate and can include tasks like creating an emergency fund, paying off credit card debt, or saving for a vacation.

- Long-term financial goals, on the other hand, focus on objectives that you want to achieve over an extended period, usually five years or more. Examples include buying a home, funding your retirement, or starting a business.

Short-term goals are like stepping stones that lead to the accomplishment of your long-term goals.

Importance of Achievable Goals

- Setting achievable goals ensures that you are realistic about what you can accomplish within a certain timeframe. This prevents you from feeling overwhelmed or discouraged if you set unattainable goals.

- Achievable goals also help you track your progress more effectively, allowing you to celebrate small victories along the way. This positive reinforcement can keep you motivated and on track towards building wealth.

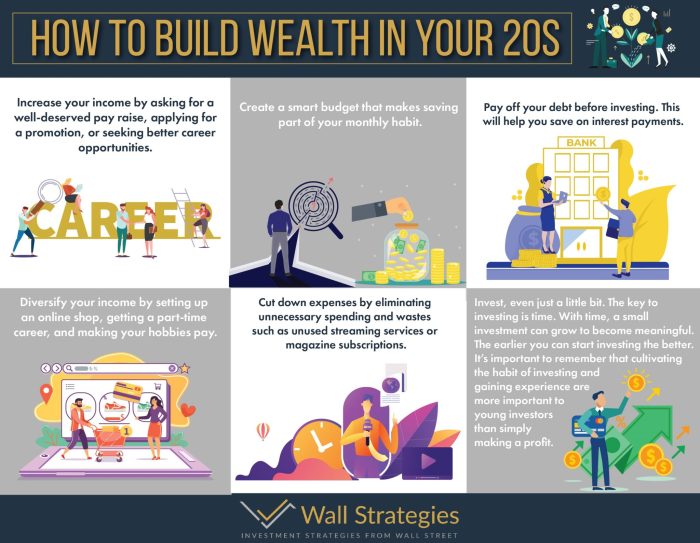

Budgeting and Saving

Budgeting and saving are essential components of building wealth. By carefully managing your expenses and setting aside a portion of your income, you can create a solid financial foundation for the future.

Creating a Budget

Creating a budget involves tracking your income and expenses to ensure that you are spending less than you earn. Start by listing all your sources of income and then categorize your expenses into fixed costs (like rent or mortgage) and variable costs (like groceries or entertainment). Set realistic limits for each category and monitor your spending regularly to stay on track.

Sticking to Your Budget

To stick to your budget, consider using cash envelopes for specific categories, automating your savings, and avoiding impulse purchases. It’s important to stay disciplined and make adjustments as needed to ensure that you are meeting your financial goals.

Paying Yourself First

The concept of paying yourself first involves prioritizing saving by setting aside a portion of your income before paying any bills or expenses. By making saving a non-negotiable part of your budget, you can build your savings consistently over time and avoid the temptation to spend all your income.

Investing Wisely

Investing wisely is a crucial step in building wealth for the long term. By putting your money to work in various asset classes, you can potentially grow your wealth over time and secure your financial future.

Importance of Diversification

Diversifying your investments across different asset classes such as stocks, real estate, and retirement accounts can help reduce risk and maximize returns. By spreading your investments, you can mitigate the impact of market fluctuations on your overall portfolio.

- Stocks: Investing in individual stocks or exchange-traded funds (ETFs) can offer the potential for high returns but also come with higher risk. It’s essential to research and choose companies with strong fundamentals and growth potential.

- Real Estate: Owning rental properties or real estate investment trusts (REITs) can provide a steady income stream and potential appreciation in property value. Conduct thorough market research and due diligence before investing in real estate.

- Retirement Accounts: Contributing to retirement accounts like 401(k)s or IRAs can help you save for the future while taking advantage of tax benefits. Consider your risk tolerance and investment timeline when selecting funds for your retirement account.

Tips for Choosing Sound Investments

When researching and selecting investment opportunities, consider the following tips to make informed decisions:

- Understand Your Risk Tolerance: Determine how much risk you are willing to take with your investments based on your financial goals and timeline.

- Do Your Homework: Conduct thorough research on potential investments, including analyzing financial statements, market trends, and the track record of investment managers.

- Diversify Your Portfolio: Spread your investments across different asset classes and industries to reduce risk and optimize returns.

- Stay Informed: Keep up-to-date with market news and economic trends that may impact your investments, and be prepared to adjust your portfolio accordingly.

Generating Additional Income Streams

Generating additional income streams is a crucial aspect of building wealth. By diversifying your income sources, you not only increase your financial stability but also open up opportunities for exponential growth. Here are some benefits of diversifying income streams for wealth-building:

Investments

Investing in stocks, real estate, or other assets can provide a steady stream of passive income. By putting your money to work for you, you can earn dividends, rental income, or capital gains without actively working for it.

Side Hustles

Starting a side business or freelancing in your spare time can be a great way to generate extra income. Whether it’s selling handmade crafts online, offering consulting services, or driving for a ride-sharing app, side hustles can supplement your main income and accelerate your wealth-building journey.

Multiple Income Sources

Having multiple income sources allows you to weather financial downturns more effectively. If one source of income dries up, you have others to fall back on. Moreover, with multiple streams of income, you can reinvest your profits into more income-generating opportunities, further boosting your wealth.

Managing Debt

Debt can have a significant impact on your efforts to build wealth. High-interest debt, in particular, can eat away at your income and hinder your ability to save and invest for the future. It’s essential to have a plan in place to reduce and manage debt effectively in order to reach your financial goals.

Strategies for Reducing and Managing Debt

- Create a budget and track your expenses to identify areas where you can cut back and allocate more money towards debt repayment.

- Consider consolidating high-interest debt into a lower-interest loan or balance transfer credit card to reduce interest costs.

- Negotiate with creditors to see if you can lower your interest rates or work out a more manageable repayment plan.

- Prioritize debt repayment by focusing on high-interest debt first while making minimum payments on other debts.

Good Debt vs. Bad Debt

- Good debt is typically used to finance assets that have the potential to increase in value over time, such as a mortgage for a home or a loan for education that can lead to higher earning potential.

- Bad debt, on the other hand, is debt used to finance depreciating assets or non-essential expenses, such as credit card debt for luxury purchases or high-interest payday loans.

It’s important to leverage good debt wisely to build wealth while avoiding accumulating too much bad debt that can hold you back financially.

Continuous Learning and Improvement

Continuous learning and improvement play a crucial role in building wealth. By constantly expanding your knowledge and honing your skills, you increase your earning potential and make better financial decisions. Staying informed about the latest trends and developments in the financial world is essential for long-term success.

Importance of Ongoing Education

Continuous education is key to staying ahead in the ever-evolving financial landscape. Whether it’s learning about new investment strategies, understanding market trends, or acquiring specialized skills, ongoing education can give you a competitive edge.

- Attending workshops, seminars, and webinars to enhance your financial knowledge.

- Pursuing certifications or advanced degrees related to finance or investing.

- Reading books, articles, and research papers on personal finance and wealth-building.

Skill Development for Increased Earning Potential

Improving your skills can directly impact your earning potential. Whether it’s mastering a new technology, becoming proficient in a particular field, or developing soft skills like communication and leadership, investing in skill development can open up new opportunities for higher-paying jobs or business ventures.

Remember, the more you learn, the more you earn.

- Enrolling in online courses or workshops to acquire in-demand skills.

- Networking with professionals in your industry to learn from their experiences and insights.

- Seeking mentorship or coaching to guide you in your career or business endeavors.