Diving into the world of Capital gains tax rates, we embark on a journey to unravel the complexities and nuances of this financial realm. From short-term to long-term gains, we explore the various facets of tax rates with a fresh perspective that will leave you informed and intrigued.

As we delve deeper, we uncover the impact of income levels, holding periods, and tax laws on these rates, painting a vivid picture of how they shape our financial landscape.

Overview of Capital Gains Tax Rates

In the world of taxes, capital gains tax rates are the real deal. These rates are the taxes you pay on the profit you make from selling an investment or property.

When it comes to capital gains tax rates, there are two main categories to keep in mind: short-term and long-term capital gains. Short-term capital gains refer to profits made from selling an asset held for one year or less, while long-term capital gains are profits from assets held for more than one year.

Now, let’s break it down and compare how capital gains tax rates differ from ordinary income tax rates.

Short-term vs. Long-term Capital Gains Tax Rates

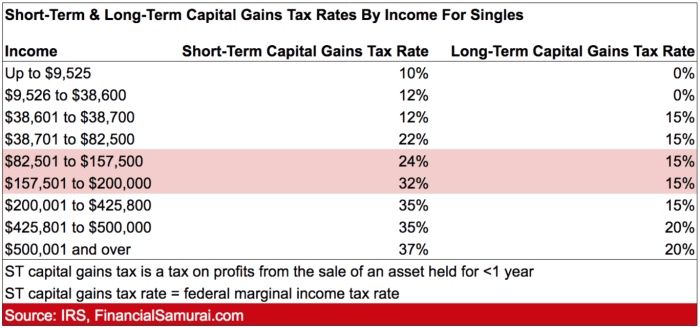

- Short-term Capital Gains Tax Rates: These rates are typically taxed at the same rate as your ordinary income tax. This means they can range from 10% to 37% depending on your income bracket.

- Long-term Capital Gains Tax Rates: On the other hand, long-term capital gains are taxed at lower rates than short-term gains. The rates can be 0%, 15%, or 20%, again depending on your income level.

It’s all about how long you hold onto your investments – the longer, the better when it comes to tax rates!

Factors Affecting Capital Gains Tax Rates

When it comes to capital gains tax rates, there are several factors that can influence how much you’ll owe to the government. Let’s take a closer look at some of the key factors that play a role in determining your capital gains tax rates.

Income Levels Impact

Your income level can have a significant impact on the capital gains tax rate you will be subject to. Generally, individuals in higher income brackets are required to pay a higher capital gains tax rate compared to those in lower income brackets. This is because the tax system is designed to be progressive, meaning those with more income are taxed at a higher rate.

Holding Period of an Asset

The length of time you hold onto an asset can also affect your capital gains tax rate. If you hold an asset for less than a year before selling it, you will be subject to short-term capital gains tax rates, which are typically higher than long-term capital gains tax rates. On the other hand, if you hold an asset for more than a year before selling it, you may qualify for lower long-term capital gains tax rates.

Tax Laws and Regulations Influence

Tax laws and regulations play a crucial role in determining capital gains tax rates. Changes in tax laws, such as adjustments to tax brackets or rates, can directly impact how much you owe in capital gains taxes. It’s important to stay informed about the latest tax laws and regulations to ensure you are accurately calculating and paying your capital gains taxes.

Calculation and Determination of Capital Gains Tax Rates

Determining capital gains tax rates involves a specific process based on various factors. Let’s break down how these rates are calculated and what influences them.

Calculation Process

- Capital gains tax rates are determined by the length of time an asset is held before it is sold. Short-term capital gains, for assets held for less than a year, are taxed at ordinary income tax rates. On the other hand, long-term capital gains, for assets held for more than a year, are taxed at lower rates.

- To calculate the tax rate for long-term capital gains, the IRS provides a set of tax brackets based on your filing status and income. These brackets determine the percentage of tax owed on your gains.

Examples

- For example, if you are a single filer with a taxable income of $50,000 and you sell an asset held for over a year with a $10,000 gain, you would fall into the 15% tax bracket for long-term capital gains.

- On the other hand, if you are a married couple filing jointly with a taxable income of $150,000 and you sell an asset held for less than a year with a $20,000 gain, you would be taxed at your regular income tax rates for short-term capital gains.

Deductions and Exemptions

- There are certain deductions and exemptions that can affect your final capital gains tax rate. For instance, if you are selling your primary residence, you may be eligible for a capital gains exclusion of up to $250,000 for individuals or $500,000 for married couples filing jointly.

- Additionally, you can offset your capital gains with capital losses from other investments to lower your overall tax liability.

Impact of Capital Gains Tax Rates on Investments

When it comes to investing, capital gains tax rates play a crucial role in shaping investment decisions. These rates can significantly affect the overall return on investment and the attractiveness of different investment opportunities. Let’s delve deeper into how capital gains tax rates impact investments.

Influence on Investment Decisions

Capital gains tax rates directly influence the after-tax return investors receive on their investments. Higher tax rates on capital gains can reduce the net profit investors make from their investments, making certain opportunities less appealing. As a result, investors may be more inclined to hold onto their investments for longer periods to defer paying taxes or choose investments with lower capital gains tax implications.

Relationship with Economic Growth

The relationship between capital gains tax rates and economic growth is complex. Lower capital gains tax rates can incentivize investment, leading to more capital flowing into the economy. This increased investment can stimulate economic growth, create jobs, and drive innovation. On the other hand, higher capital gains tax rates may discourage investment, potentially slowing down economic activity and overall growth.

Strategies to Minimize Impact

- Utilize tax-advantaged accounts: Investing through retirement accounts or other tax-advantaged vehicles can help minimize the impact of capital gains taxes on investments.

- Strategic timing: Timing the sale of investments to take advantage of lower tax rates or utilizing strategies like tax-loss harvesting can help reduce the tax burden on capital gains.

- Diversification: Spreading investments across different asset classes can help manage the impact of capital gains tax rates on overall investment returns.

- Consider long-term investments: Holding onto investments for the long term can qualify for lower long-term capital gains tax rates, reducing the tax liability on investment gains.