Diving into the world of Retirement age statistics opens up a fascinating exploration of how different countries, professions, and societal factors shape the age at which individuals retire. From economic influences to gender disparities, this topic delves into a complex web of trends and patterns that define retirement age across the globe.

As we navigate through the nuances of retirement age statistics, we uncover insights that shed light on the diverse factors influencing when individuals choose to embark on their golden years.

Overview of Retirement Age Statistics

Retirement age is the age at which individuals choose to stop working and rely on their savings, pension, or other sources of income. It holds significant importance in different countries as it affects the economy, social security systems, and workforce dynamics.

Variations in retirement age can be observed across different professions based on factors like physical demands, skill requirements, and industry norms. For example, professions that are physically taxing may have a lower retirement age compared to those that are less strenuous.

Retirement age statistics are calculated and analyzed by collecting data on the age at which individuals in various professions choose to retire. This data is then used to determine trends, patterns, and potential impacts on the labor market and retirement systems.

Factors Influencing Retirement Age

Retirement age can be influenced by various factors including economic conditions, changes in life expectancy, and government policies.

Impact of Economic Conditions

Economic conditions play a significant role in determining retirement age. In times of economic instability or recession, individuals may be forced to delay retirement due to financial constraints. On the other hand, a strong economy and job market may encourage earlier retirement.

Changes in Life Expectancy

The increase in life expectancy over the years has also impacted retirement age trends. As people are living longer, they may choose to work longer to ensure financial security during their extended retirement years. Conversely, some individuals may opt to retire earlier to enjoy their retirement while they are still healthy and active.

Government Policies Influence

Government policies such as changes in retirement benefits, social security eligibility age, and pension regulations can greatly influence retirement age decisions. For example, raising the retirement age for social security benefits may prompt individuals to work longer before retiring to maximize their benefits.

Global Comparison of Retirement Age

In the global landscape, retirement age varies significantly from country to country, influenced by a myriad of factors such as economic conditions, government policies, and cultural norms.

Countries with the Highest and Lowest Retirement Ages

- France and Hungary are examples of countries with relatively low retirement ages, typically around 62-64 years old.

- On the other hand, countries like Norway and Iceland have some of the highest retirement ages, often reaching 67-68 years old.

Retirement Age Trends in Developed vs. Developing Countries

- In developed countries such as the United States and Japan, there is a trend towards increasing the retirement age due to longer life expectancy and financial sustainability of pension systems.

- In contrast, developing countries like India and Brazil often have lower retirement ages, reflecting different economic and social structures.

Cultural Factors Influencing Retirement Age Decisions Worldwide

- Cultural norms around work ethic and family obligations play a significant role in determining retirement age, with some cultures valuing early retirement for leisure while others prioritize working longer for financial security.

- In countries with strong social safety nets, individuals may feel more comfortable retiring earlier, while in countries with limited support, people may work longer to ensure their financial stability.

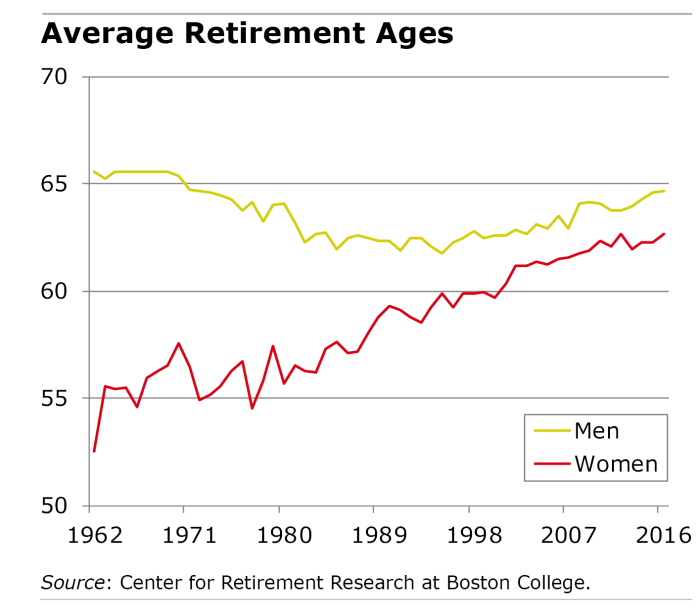

Gender Disparities in Retirement Age

When it comes to retirement age, there are significant differences between men and women. Societal norms and gender roles play a crucial role in shaping these statistics. Additionally, the gender pay gap also has a direct impact on retirement age disparities.

Differences in Retirement Age

- On average, women tend to retire earlier than men. This can be attributed to various factors such as caregiving responsibilities, lower lifetime earnings, and societal expectations.

- Men often have higher retirement savings compared to women, allowing them to retire later and enjoy a more financially secure retirement.

Societal Norms and Gender Roles

- Traditional gender roles often dictate that women should prioritize family and caregiving duties over their careers, leading to earlier retirement.

- Conversely, men are expected to be the primary breadwinners, which may motivate them to work longer and delay retirement.

Impact of Gender Pay Gaps

- The gender pay gap results in women earning less over their careers, ultimately affecting their retirement savings and contributing to earlier retirement.

- Women are more likely to rely on social security benefits in retirement, which are typically lower than private pensions, further widening the retirement age gap between genders.