Diving deep into the world of Online brokerage platforms, get ready to explore the ins and outs of this financial frontier. From the basics to the advanced features, this guide will equip you with everything you need to know.

Get ready to embark on a journey through the realm of online investing and trading, where opportunities abound and possibilities are endless.

Overview of Online Brokerage Platforms

Online brokerage platforms are digital platforms that allow individuals to buy and sell financial securities such as stocks, bonds, and mutual funds through the internet. These platforms provide users with access to markets and investment opportunities that were traditionally only available to professional investors.

Key features and benefits of using online brokerage platforms include:

– Convenience: Users can trade anytime, anywhere, without the need to visit a physical broker’s office.

– Lower fees: Online platforms typically charge lower fees and commissions compared to traditional brokerage firms.

– Research tools: Many online brokerage platforms offer research tools, educational resources, and real-time market data to help users make informed investment decisions.

– Diversification: Users can easily diversify their investment portfolios by accessing a wide range of securities and asset classes.

Some popular online brokerage platforms in the market include:

– Robinhood: Known for its commission-free trading and user-friendly interface.

– TD Ameritrade: Offers a wide range of investment products and tools for both beginner and experienced investors.

– E*TRADE: Provides a variety of trading options and educational resources for users at all levels of experience.

Online brokerage platforms have revolutionized the way individuals invest in the stock market. They offer a convenient and cost-effective way for users to access a wide range of investment opportunities and manage their portfolios effectively.

Opening an Account on Online Brokerage Platforms

Opening an account on online brokerage platforms is a straightforward process that typically involves a few key steps. Let’s break down the process and discuss the documentation required for account creation.

Steps to Open an Account

- Choose a Brokerage Platform: Research and select a reputable online brokerage platform that meets your investment needs.

- Create an Account: Visit the platform’s website and click on the “Open an Account” or “Sign Up” button.

- Provide Personal Information: Fill out the required fields with your personal information, such as name, address, date of birth, and contact details.

- Verify Identity: Upload a copy of your identification documents, such as a driver’s license or passport, to verify your identity.

- Fund the Account: Deposit funds into your new brokerage account to start trading or investing.

- Agree to Terms and Conditions: Review and accept the platform’s terms and conditions to complete the account opening process.

Documentation Required

- Government-issued ID: A copy of your driver’s license, passport, or other government-issued ID for identity verification.

- Proof of Address: A recent utility bill, bank statement, or lease agreement to confirm your residential address.

- Social Security Number: Some platforms may require your SSN for tax reporting purposes.

- Funding Source Information: Details of the bank account or credit/debit card you plan to use to fund your brokerage account.

Comparison of Account Opening Processes

| Brokerage Platform | Account Opening Process |

|---|---|

| Platform A | Requires ID verification through a video call in addition to document upload. |

| Platform B | Offers a mobile app for account opening with quick approval process. |

| Platform C | Has a manual verification process that may take longer than other platforms. |

Investment Options and Tools

Investing through online brokerage platforms opens up a world of opportunities for traders and investors. These platforms offer a wide range of investment options and tools to help users make informed decisions and manage their portfolios effectively.

Investment Options

- Stocks: Online brokerage platforms allow users to buy and sell shares of publicly traded companies, giving them the opportunity to invest in individual companies and potentially benefit from their growth.

- ETFs (Exchange-Traded Funds): ETFs are collections of securities that trade on an exchange, providing investors with diversified exposure to various asset classes, industries, or regions.

- Mutual Funds: These are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Tools and Resources

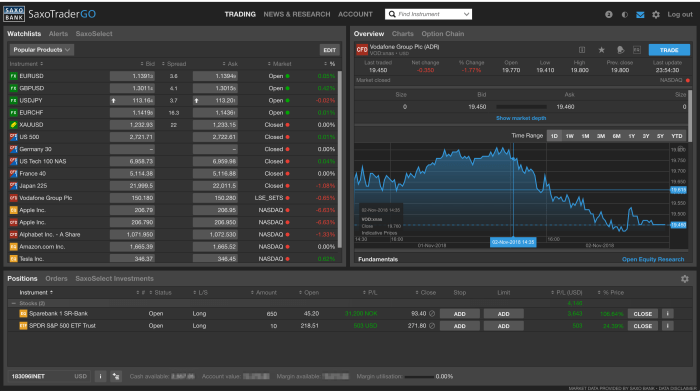

- Real-Time Market Data: Online brokerage platforms provide users with up-to-date information on stock prices, market trends, and news to help them make informed investment decisions.

- Research Reports: Users can access research reports, analyst recommendations, and company profiles to gain insights into potential investment opportunities.

- Financial Calculators: Tools like risk assessment calculators, retirement planners, and investment calculators help users plan and manage their finances effectively.

Investment Strategies

- Long-Term Investing: Online brokerage platforms cater to long-term investors by providing resources for fundamental analysis, portfolio diversification, and investment planning.

- Day Trading: For users interested in day trading, these platforms offer advanced charting tools, technical analysis resources, and real-time trading capabilities to execute quick trades.

Fees and Commissions

Online brokerage platforms typically charge various fees to users, including commission fees for trades and account maintenance fees. It’s essential for investors to understand these fee structures to make informed decisions about their investments.

Breakdown of Fee Structure

When using online brokerage platforms, investors may encounter commission fees for buying and selling securities, account maintenance fees for managing their accounts, and other miscellaneous fees like transfer fees or inactivity fees. It’s crucial to review the fee schedule of each platform to understand the costs involved.

Comparison of Fee Structures

Different online brokerage platforms have varying fee structures, with some offering commission-free trades while others may charge a flat fee per trade or a percentage of the transaction amount. Investors should compare these fee structures to find a platform that aligns with their investment goals and budget.

Minimizing Fees

Investors can minimize fees while using online brokerage platforms by being mindful of their trading activity, opting for platforms with lower commission fees, taking advantage of fee-free ETFs or mutual funds, and avoiding unnecessary transactions that may incur additional charges. By staying informed and strategic, investors can keep their costs low and maximize their returns.