Yo, listen up! Understanding inflation is like, super important in the world of economics. It’s like this invisible force that messes with prices and stuff. So, buckle up and get ready to dive deep into this fascinating topic.

Inflation, man, it’s a wild ride that affects everything from the cost of goods to job opportunities. Let’s break it down and see what it’s all about.

What is Inflation?

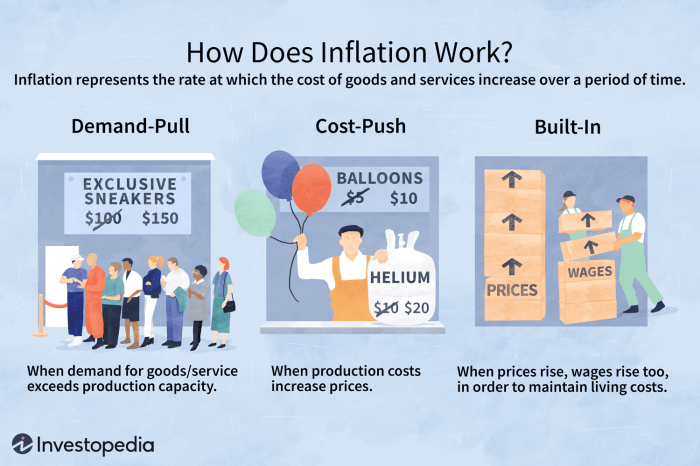

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. It affects the economy by eroding the value of money, reducing the real value of savings, and increasing the cost of living.

Causes of Inflation

- 1. Demand-Pull Inflation: This type of inflation occurs when aggregate demand exceeds the available supply of goods and services, leading to an increase in prices.

- 2. Cost-Push Inflation: Cost-push inflation happens when the cost of production increases, causing producers to raise prices to maintain their profit margins.

Factors Influencing Inflation

Inflation rates are affected by various factors that play a crucial role in shaping the economy. Understanding these factors is essential to comprehend the dynamics of inflation.

Monetary Policy Influence

Monetary policy, implemented by central banks, can significantly impact inflation rates. By adjusting interest rates, controlling money supply, and regulating credit availability, central banks aim to stabilize prices and manage inflation levels.

Supply and Demand Dynamics

The fundamental economic principle of supply and demand also plays a key role in influencing inflation. When demand exceeds supply for goods and services, prices tend to rise, leading to inflation. Conversely, when supply surpasses demand, prices may fall, causing deflation.

External Factors: International Trade and Geopolitical Events

External factors such as international trade relations and geopolitical events can have a significant impact on inflation. Trade agreements, tariffs, and global economic conditions can influence the prices of imported goods, affecting domestic inflation rates. Geopolitical events, such as wars or political instability, can disrupt supply chains, leading to inflationary pressures.

Measuring Inflation

Inflation is a crucial economic indicator that affects the purchasing power of consumers and the overall health of an economy. To accurately measure inflation, various metrics and methodologies are used. Let’s dive into the common ways inflation is measured and the limitations of these measurement tools.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is one of the most widely used metrics to measure inflation. It tracks the changes in prices of a fixed basket of goods and services typically purchased by urban consumers. The CPI is calculated monthly by the Bureau of Labor Statistics and provides a snapshot of how prices are changing over time for consumers.

Producer Price Index (PPI)

In contrast to the CPI, the Producer Price Index (PPI) measures the average changes in selling prices received by domestic producers for their goods and services over time. This index is essential for businesses as it can help them adjust their pricing strategies based on inflationary trends in production costs.

Comparing and Contrasting Metrics

While both the CPI and PPI serve as valuable tools for measuring inflation, they differ in their focus and target audience. The CPI mainly reflects consumer spending patterns, while the PPI offers insights into production costs. By analyzing both indices, policymakers and economists can gain a comprehensive understanding of inflationary pressures across different sectors of the economy.

Limitations of Inflation Measurement

Despite their utility, inflation measurement tools like the CPI and PPI have limitations. One common criticism is that these indices may not fully capture the impact of rapidly changing prices in dynamic markets. Additionally, the fixed basket of goods used in the CPI may not always reflect the actual consumption patterns of diverse consumer groups, leading to potential inaccuracies in measuring inflation.

Effects of Inflation

When inflation occurs, it can have a significant impact on various aspects of the economy, affecting individuals, businesses, and the overall financial landscape.

Impact on Purchasing Power

Inflation reduces the purchasing power of money, meaning that the same amount of money can buy fewer goods and services over time. As prices increase, consumers find it more expensive to purchase the same items they used to buy, leading to a decrease in their standard of living.

Effect on Interest Rates and Investment Decisions

Inflation can influence interest rates, as central banks may raise rates to combat rising prices. Higher interest rates can deter individuals and businesses from borrowing money for investments, as the cost of borrowing becomes more expensive. This can impact investment decisions and slow down economic growth.

Influence on Wage Levels and Employment

When inflation occurs, wages often need to increase to keep up with the rising cost of living. However, if wages do not rise at the same rate as inflation, the real value of income decreases. This can lead to reduced purchasing power for workers and potentially impact consumer spending. Additionally, businesses may struggle to afford higher wage costs, potentially leading to job cuts or reduced hiring, affecting overall employment levels.

Strategies to Combat Inflation

Inflation can have a significant impact on the economy, affecting prices, wages, and overall financial stability. Central banks employ various strategies to control inflation, aiming to maintain price stability and sustainable economic growth. Let’s explore some of the key approaches used to combat inflation.

Central Bank Strategies

- One common strategy used by central banks is monetary policy, which involves adjusting interest rates to influence borrowing, spending, and investment in the economy. By raising interest rates, central banks can reduce the money supply, slowing down inflation.

- Another strategy is open market operations, where central banks buy or sell government securities to control the money supply. By selling securities, central banks can reduce the money supply and combat inflation.

- Central banks may also use reserve requirements to regulate the amount of cash commercial banks must hold in reserve, impacting their ability to lend money. Adjusting reserve requirements can help control inflation by limiting excessive lending.

Inflation-Targeting Policies

- Inflation-targeting policies involve setting a specific inflation target and using monetary policy tools to achieve it. While these policies provide transparency and accountability, they may lead to higher unemployment rates in the short term as central banks prioritize price stability over other economic goals.

- Pros of inflation-targeting policies include increased credibility, reduced uncertainty, and improved long-term economic performance. However, critics argue that focusing solely on inflation may neglect other important economic indicators.

Alternative Measures for Hyperinflation

- When facing hyperinflation, central banks may resort to unconventional measures such as currency redenomination, where a new currency unit is introduced to replace the old one at a lower value. This can help stabilize prices and restore confidence in the currency.

- Another approach is dollarization, where a country adopts a foreign currency as its official currency to combat hyperinflation and restore economic stability. While this can provide immediate relief, it may limit the ability to conduct independent monetary policy.