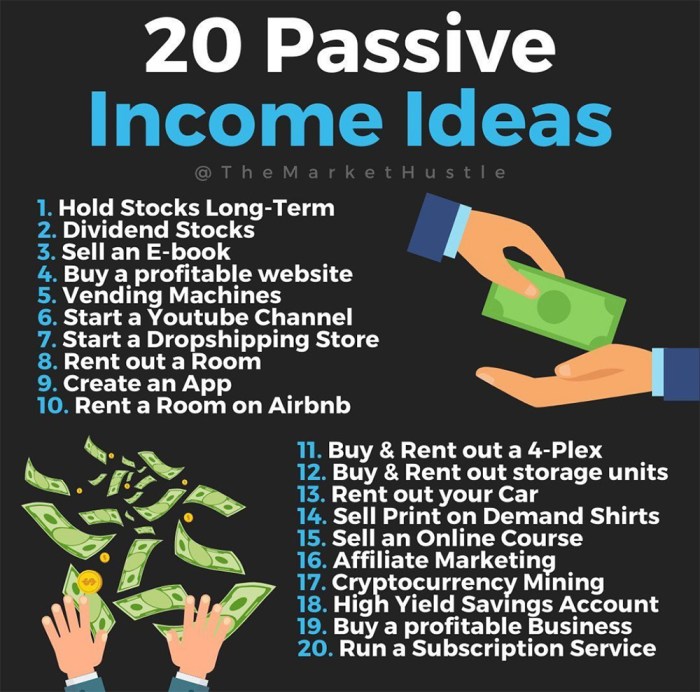

Passive income ideas set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From rental income to online ventures, explore the world of generating income while you sleep.

Types of Passive Income Streams

Passive income streams are a great way to earn money without actively working for it. Unlike active income where you trade time for money, passive income allows you to make money even while you sleep. There are various types of passive income streams that you can explore to build wealth over time.

Rental Income

Rental income is a popular form of passive income where you earn money by renting out property that you own. This can include residential properties, commercial spaces, or vacation rentals. Successful real estate investors generate a steady stream of passive income through rental properties.

Dividend Stocks

Investing in dividend stocks is another way to earn passive income. When you invest in dividend-paying companies, you receive a portion of the company’s profits in the form of dividends. Many investors build a portfolio of dividend stocks to create a passive income stream.

Royalties

Royalties are payments that you receive for the use of your intellectual property. This can include royalties from books, music, patents, or trademarks. Successful authors, musicians, and inventors can earn passive income through royalties for years to come.

Affiliate Marketing

Affiliate marketing involves promoting products or services through affiliate links and earning a commission for every sale made through your referral. Many bloggers, YouTubers, and social media influencers use affiliate marketing to generate passive income by recommending products they love.

Creating Passive Income through Investments

Investing is a popular way to generate passive income. By putting your money into different assets, you can earn money without actively working for it. Let’s explore some common investment opportunities for creating passive income.

Real Estate

Investing in real estate can be a lucrative way to generate passive income. You can earn rental income from properties or make money through property appreciation. However, real estate investments require a significant upfront investment and come with risks like market fluctuations and property management.

Stocks

Stocks offer the opportunity to earn passive income through dividends. By investing in dividend-paying stocks, you can receive regular payments without selling your shares. Stocks also have the potential for capital appreciation, but they come with market volatility and the risk of losing your investment.

Bonds

Bonds are another investment option for creating passive income. When you buy a bond, you are essentially lending money to a corporation or government in exchange for regular interest payments. Bonds are considered safer than stocks but offer lower returns. However, they can provide stability to your investment portfolio.

Peer-to-Peer Lending

Peer-to-peer lending platforms allow you to lend money to individuals or businesses in exchange for interest payments. This investment option can provide higher returns than traditional savings accounts, but it also comes with the risk of borrower defaults. Diversifying your loans across multiple borrowers can help mitigate this risk.

Building a diversified investment portfolio is crucial for maximizing your passive income potential. By spreading your investments across different asset classes like real estate, stocks, bonds, and peer-to-peer lending, you can reduce risk and increase your chances of earning consistent passive income over time.

Online Passive Income Ideas

Creating passive income online can be a lucrative way to earn money with minimal effort. There are various strategies to generate passive income through online platforms, such as creating digital products, starting a niche website, or selling stock photos. These methods require initial setup and effort, but once established, they can generate income on autopilot.

Creating Digital Products

Creating digital products, such as ebooks, online courses, or software, can be a great way to earn passive income online. Here are the steps involved in setting up this passive income stream:

- Identify a niche or topic you are knowledgeable about.

- Create valuable digital content that provides solutions or information to your target audience.

- Set up a sales platform, such as an online store or a marketplace, to sell your digital products.

- Market your digital products through social media, email marketing, or online advertising to drive traffic and increase sales.

- Optimize your sales funnel to maximize conversions and increase passive income earnings.

Starting a Niche Website

Starting a niche website focused on a specific topic or industry can be another effective way to generate passive income online. Here are the steps involved in setting up this passive income stream:

- Choose a niche with high demand and low competition.

- Buy a domain name and set up a website hosting platform.

- Create high-quality content that provides value to your target audience.

- Monetize your website through affiliate marketing, display ads, or selling digital products.

- Optimize your website for search engines to drive organic traffic and increase passive income earnings.

Selling Stock Photos

Selling stock photos online can be a passive income stream for photographers or hobbyists with a collection of high-quality images. Here are the steps involved in setting up this passive income stream:

- Organize and categorize your stock photo collection.

- Sign up with stock photography websites or marketplaces to sell your images.

- Upload your photos with relevant s and descriptions to attract buyers.

- Promote your stock photos through social media, portfolio websites, and photography forums.

- Monitor sales and trends to optimize your stock photo portfolio for maximum passive income earnings.

Passive Income through Rental Properties

Investing in rental properties can be a lucrative way to generate passive income over time. By purchasing properties and renting them out, you can enjoy a steady stream of income without having to put in daily effort. Let’s delve into the benefits of this passive income stream and how to make the most of it.

Benefits of Investing in Rental Properties

- Diversification: Rental properties offer a way to diversify your investment portfolio beyond stocks and bonds.

- Steady Income: Rental properties can provide a consistent monthly income stream, helping to cover expenses and build wealth.

- Tax Advantages: Investors can benefit from tax deductions on mortgage interest, property taxes, maintenance costs, and more.

Considerations When Purchasing Rental Properties

- Location: Choose properties in desirable locations with low vacancy rates and strong rental demand.

- Property Type: Consider the type of property that aligns with your investment goals, whether it be single-family homes, multi-unit buildings, or commercial spaces.

- Rental Market Analysis: Conduct thorough research on the rental market in the area to ensure that rental rates are competitive and sustainable.

Tips for Managing Rental Properties Efficiently

- Screen Tenants Carefully: Take the time to screen potential tenants to find reliable renters who will pay on time and take care of the property.

- Maintain Regular Communication: Stay in touch with tenants to address any concerns promptly and maintain a positive landlord-tenant relationship.

- Set Aside Emergency Funds: Prepare for unexpected expenses by setting aside a portion of your rental income for repairs, maintenance, and vacancies.