Diving into the world of Mutual funds vs. ETFs, get ready for a deep dive into the differences and similarities between these two popular investment options. From cost structures to tax efficiencies, this comparison will give you a clear picture of what sets them apart.

Introduction to Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are popular investment options that allow individuals to invest in a diversified portfolio without the need for extensive market knowledge or research.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds are priced once a day after the market closes.

ETFs

ETFs are similar to mutual funds in that they also offer a diversified portfolio of securities. However, ETFs are traded on stock exchanges like individual stocks throughout the trading day. They are passively managed and aim to replicate the performance of a specific index, sector, or commodity.

Key Characteristics and Differences

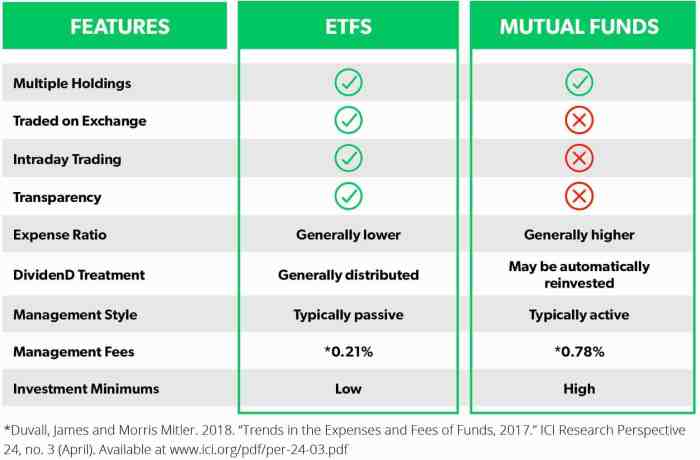

– Mutual funds are priced once a day, while ETFs are traded throughout the day.

– Mutual funds may have minimum investment requirements, while ETFs can be purchased in single shares.

– Mutual funds may have higher fees due to active management, while ETFs typically have lower expense ratios.

– Mutual funds may be more tax-efficient due to the ability to redeem shares directly with the fund company, while ETFs may incur capital gains taxes when sold on the market.

Cost Comparison

When it comes to comparing the cost structures of mutual funds and ETFs, there are a few key differences to consider. Mutual funds typically have higher expense ratios and fees compared to ETFs. These fees can eat into the overall returns for investors, so it’s important to understand how they impact your investment.

Fees Associated with Mutual Funds

- Mutual funds often charge a management fee, which can range from 0.5% to 2% of your total investment.

- Some mutual funds also have a sales load or commission fee, which is a one-time fee paid when you buy or sell shares in the fund.

- Additionally, mutual funds may have 12b-1 fees, which are marketing and distribution fees that can further reduce your returns.

Fees Associated with ETFs

- ETFs typically have lower expense ratios compared to mutual funds, ranging from 0.05% to 0.75%.

- ETFs do not have sales loads or 12b-1 fees, making them a more cost-effective investment option.

- However, investors may incur trading costs when buying and selling ETF shares, depending on the brokerage platform used.

Impact on Overall Returns

Expense ratios play a significant role in determining the overall returns for investors. A lower expense ratio means more of your investment returns stay in your pocket.

Overall, the cost structure of mutual funds tends to be higher due to management fees, sales loads, and 12b-1 fees. On the other hand, ETFs offer lower expense ratios and no sales loads, making them a more cost-effective choice for investors looking to maximize their returns.

Liquidity and Trading

When it comes to liquidity and trading, mutual funds and ETFs have some key differences that investors should be aware of. Liquidity refers to how easily an asset can be bought or sold without affecting its price significantly. In the case of mutual funds and ETFs, this can impact how quickly investors can access their money or make changes to their investments.

Liquidity Differences

- Mutual funds are typically less liquid than ETFs because they only trade at the end of the trading day at the net asset value (NAV). This means investors may not be able to buy or sell mutual fund shares at the exact price they see.

- On the other hand, ETFs trade throughout the day on exchanges like stocks, so investors can buy or sell at market prices whenever the market is open. This provides greater flexibility and potentially better pricing for investors.

Trading ETFs vs. Mutual Funds

- When trading ETFs, investors place orders with a broker through their brokerage account, similar to buying or selling individual stocks. This allows for intraday trading and the ability to set limit orders or stop orders.

- With mutual funds, investors typically buy or sell shares directly through the fund company at the end of the trading day. This means investors may not know the exact price they are buying or selling at until after the market closes.

Impact of Liquidity on Investment Experience

- For investors needing quick access to their money or looking to capitalize on short-term market movements, ETFs may offer a more liquid and flexible option compared to mutual funds.

- However, for long-term investors focused on buy-and-hold strategies, the liquidity differences between mutual funds and ETFs may have less of an impact on their investment experience.

Tax Efficiency

When it comes to investing in mutual funds versus ETFs, understanding the tax implications is crucial. Let’s dive into the comparison of tax efficiency between these two investment vehicles and provide scenarios to illustrate the advantages and disadvantages of each.

Tax Implications

Investing in mutual funds can lead to tax consequences due to capital gains distributions, which are passed on to investors. These distributions are taxed at different rates depending on how long the fund held the assets. On the other hand, ETFs are generally more tax-efficient because of their unique structure.

Comparison of Tax Efficiency

ETFs are known for their tax efficiency compared to mutual funds because of how they are structured. ETFs have the ability to create and redeem shares, which can help minimize capital gains taxes. This feature makes ETFs more attractive for investors looking to reduce their tax liabilities.

Scenarios

Scenario 1: Investor A holds a mutual fund that experiences a high level of trading activity, resulting in frequent capital gains distributions. As a result, Investor A may face higher tax liabilities compared to Investor B, who holds an ETF with lower turnover and fewer capital gains distributions.

Scenario 2: During a market downturn, both Investor A and Investor B decide to sell their investments. Investor A may incur capital gains taxes from the mutual fund, while Investor B selling ETF shares may have lower capital gains due to the tax-efficient structure of ETFs.